Tax research has always been the hidden weight of accounting. Rules stretch across thousands of pages, new rulings arrive without warning, and every answer must be airtight.

The result? Hours lost to searching, cross-referencing, and second-guessing—time that accountants can’t bill and firms can’t spare. That’s why AI Tax solutions are attracting so much attention.

Instead of wading through manuals and PDFs, professionals can now ask natural-language questions and receive source-backed answers in seconds. What once felt like a bottleneck is turning into a strategic advantage.

This blog explores how AI in tax is reshaping research for firms of all sizes—why the old way no longer works, how modern AI tax software changes the equation, and what benefits professionals can expect as these tools become mainstream.

The Evolution of Tax Research

Tax research has always been a cornerstone of the profession—but the way it’s done has shifted dramatically over time.

From Library Stacks to Digital Databases

In the past, a tax professional’s desk was covered in heavy binders, marked-up legislation, and case law digests. Research was linear: flip through pages, cross-reference footnotes, and slowly build confidence in an answer.

The process was slow, but predictable. Clients knew that getting a “yes” or “no” might take hours or days, and accuracy was understood to require patience.

The move to digital tools promised speed. Databases like LexisNexis, CCH, and specialized tax libraries gave professionals search functionality. But even then, searches often returned hundreds of results.

Sifting through PDFs and portals still demanded human endurance.

When Speed Became a Non-Negotiable

Today, the pace of tax work has changed. Regulations don’t trickle out quarterly—they can appear overnight, with amendments layered on top of existing rules. Case law decisions pile up weekly. Clients expect clarity in real time, not “I’ll get back to you next week.”

The pressure is sharper for smaller firms. Without teams of junior staff to split the workload, partners themselves often get pulled into manual research. The opportunity cost is massive: time spent scrolling through statutes is time not spent on client strategy or growth.

The Research Paradox

Here’s the paradox: accuracy matters more than ever, but the systems designed to guarantee accuracy are slowing firms down. Every additional lookup, every new citation check, every PDF download eats into billable hours.

For modern firms, research isn’t just about finding the right answer—it’s about finding it fast enough to stay competitive. And that’s the gap where AI tax solutions are stepping in.

Why Traditional Research No Longer Works

Even with digital databases and online portals, traditional tax research feels like running through a maze with moving walls. The information is there—but finding it takes more time and energy than most firms can spare.

Fragmented Knowledge, Fragmented Time

Tax guidance isn’t stored in a single place. It’s scattered across:

- subscription portals,

- government websites,

- firm archives, and

- PDF updates buried in email.

Each search means switching platforms, reconciling slightly different versions, and hoping nothing slips through the cracks.

A 2023 Wolters Kluwer study found that managers spend 8–15% of their time on complex research tasks rather than applying expertise directly. (wolterskluwer.com) Multiply that across dozens of queries per week, and the productivity loss is obvious.

Inconsistent Results

Even when the same question is asked, two professionals may arrive at different answers. Why? Because each one may prioritize a different source or interpret slightly different language.

This inconsistency isn’t about skill—it’s about access. Without a unified system, accuracy depends too heavily on the individual’s research path.

The Squeeze on Smaller Firms

Larger firms can distribute the workload across research teams. Smaller firms don’t have that luxury. For a five-person practice, a partner spending half a day on one research query is a major opportunity cost.

It means fewer hours for client service, business development, or advisory work.

The irony is that smaller firms often need agility the most, but the tools they rely on slow them down the most.

When “Good Enough” Isn’t Good Enough

Tax research doesn’t allow shortcuts. A misread clause or outdated citation isn’t just an inconvenience—it can lead to incorrect filings, compliance penalties, or loss of client trust. Professionals can’t simply guess; they need to be certain.

That’s the real problem with traditional research methods: they demand too much time while offering too little certainty. In an environment where regulations change rapidly and client expectations are higher than ever, the old way no longer scales.

What “AI Tax” Really Means

When most professionals hear AI in tax, they imagine robots replacing accountants or software spitting out entire tax returns automatically. The truth is far less dramatic—and far more useful.

AI in tax is not about replacing expertise; it’s about amplifying it. Think of it as a research partner that never gets tired, never forgets a ruling, and can scan thousands of documents in seconds.

From Guesswork to Grounded Answers

The value of AI tax solutions lies in grounding answers in trusted sources. Instead of generic outputs, these systems are designed to pull directly from:

- official legislation,

- government rulings,

- case law, and

- curated firm knowledge bases.

That grounding matters. A Wolters Kluwer survey found that 73% of tax professionals feel they spend too much time searching for information rather than applying expertise (wolterskluwer.com).

AI doesn’t just save time—it gives professionals confidence that the answer is traceable and defensible.

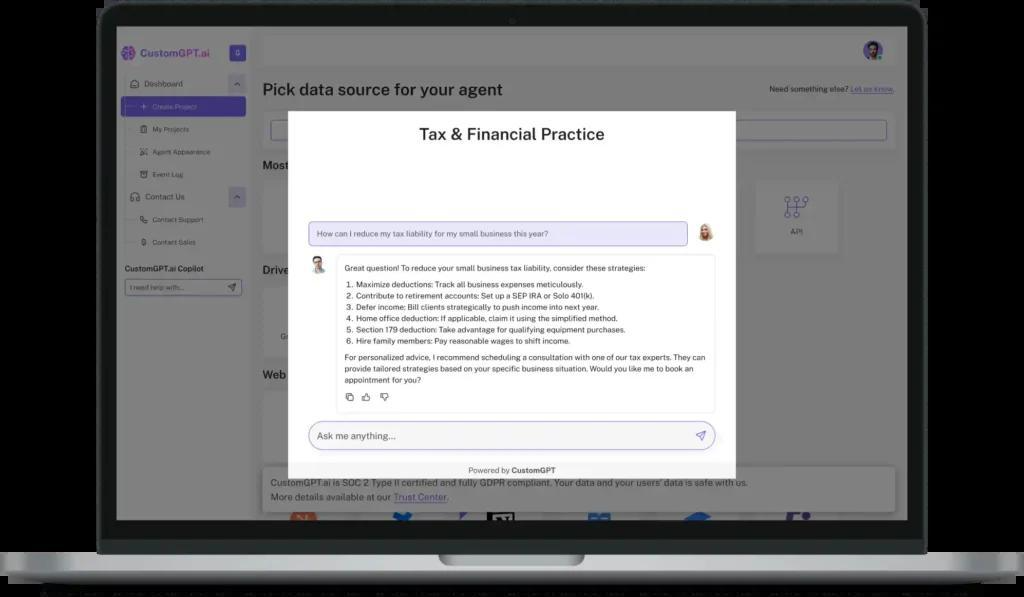

Plain Language Meets Complex Law

Instead of hours spent digging through statutes, professionals can now ask a question in plain English “Does this new ruling apply to small partnerships in Ireland?”

The AI assistant doesn’t “guess.” It surfaces the relevant clause, cites the source, and points directly to the original document. The professional still reviews it, but the heavy lifting is already done.

A Partnership, Not a Replacement

The role of the accountant doesn’t shrink with AI—it expands. By offloading repetitive research, AI tax assistants give professionals more room to:

- focus on client relationships

- deliver proactive advisory services,

- spot patterns across cases, and

- think strategically instead of reactively.

This shift aligns with broader industry trends. According to the Thomson Reuters 2025 State of Tax Professionals Report, 49% of firms say technology adoption is now their top priority for improving profitability (thomsonreuters.com).

The Spreadsheet Analogy

When spreadsheets first appeared, they didn’t eliminate accountants—they revolutionized how they worked. What once required manual ledgers became faster, more accurate, and scalable.

AI tax assistants are the next leap forward. They don’t rewrite the role of tax professionals; they give them sharper tools to keep pace with complexity and client demand.

How AI Is Changing Tax Research

The shift isn’t theoretical—it’s already happening in firms of every size. AI assistants are beginning to handle the routine work that once consumed hours, turning tax research into a faster, more precise process.

Imagine the difference in something as common as interpreting a new tax ruling.

- The old way: An accountant spends two hours combing through legislative updates, cross-checking interpretations across PDFs, and confirming citations. By the time the answer is ready, other client work has already been delayed.

- The AI way: The same query is typed in plain language. Within seconds, the assistant surfaces the relevant clause, provides the source document, and highlights any jurisdiction-specific notes. The professional still reviews the answer, but the heavy lifting is already done.

The value comes to life in four areas:

- Speed without shortcuts → Complex queries are answered in seconds, not hours, with direct links to source material.

- Consistency at scale → Instead of depending on memory or scattered notes, AI draws from a centralized, updated knowledge base.

- Citations you can trust → Every answer points back to the original regulation or ruling, building confidence instead of doubt.

- More time for judgment → By automating repetitive lookups, AI frees professionals to focus on interpretation, strategy, and client relationships.

The point isn’t replacement—it’s amplification. Just as spreadsheets multiplied the impact of accountants decades ago, AI assistants are becoming the next essential tool, quietly removing bottlenecks and making room for higher-value work.

Challenges and Limitations of AI in Tax

As promising as AI sounds, it isn’t a magic button. Tax is a high-stakes field, and professionals can’t afford half-answers or misplaced confidence. AI tools bring new capabilities, but they also come with boundaries that must be respected.

- Ambiguity in language → Tax codes are full of phrases that can be interpreted in multiple ways. AI can highlight options, but it still takes human expertise to decide which interpretation applies.

- Jurisdictional nuance → Rules that look similar on the surface often differ subtly between regions. Without careful training and review, an assistant might miss those distinctions.

- Data quality and updates → An AI system is only as reliable as the sources it draws from. If legislation isn’t kept current, the risk of outdated answers rises quickly.

- Trust and oversight → Even with source-backed citations, professionals need to validate outputs. AI should support judgment, not replace it.

These limitations don’t undermine the technology—they shape how it should be used. The firms seeing the most success aren’t the ones handing everything over to machines; they’re the ones combining AI’s speed with professional expertise.

The human role doesn’t disappear; it shifts to oversight, interpretation, and client communication.

Benefits for Accountants and Firms

The promise of AI Tax solutions isn’t just speed—it’s a rebalancing of how professionals spend their time. Instead of being buried in lookups and cross-references, accountants can focus on judgment, strategy, and client relationships.

Key benefits include:

- Faster decisions → Queries that once took hours can now be answered in seconds, complete with citations.

- Error reduction → Automated cross-checking against updated sources minimizes misinterpretation.

- Audit readiness → Every answer is traceable to its source, creating confidence in both client meetings and regulatory reviews.

- Scalability → A single assistant can handle thousands of queries daily, something no small firm could sustain manually.

- Client trust → By delivering clear, source-backed answers quickly, firms strengthen their credibility.

TaxWorld’s experience illustrates these benefits in practice: their assistant Ezylia processes thousands of questions a day while maintaining accuracy and client trust.

But the advantages extend far beyond one firm—any practice facing time pressure and research overload can gain similar leverage by pairing AI with human expertise.

The Future of AI in Tax Research

AI in tax is still early, but the direction is unmistakable.

What began as simple chatbots answering routine questions is evolving into full-scale assistants that can keep pace with constantly shifting regulations, reconcile conflicting rules, and surface insights across jurisdictions.

Globally, adoption is accelerating. Smaller firms see AI as a way to compete with larger competitors, while enterprise firms view it as insurance against complexity and scale.

Regulatory bodies themselves are also experimenting with AI-driven systems, hinting at a future where the same technology that powers firms may shape how rules are published and enforced.

Several trends are shaping what comes next:

- Predictive guidance → AI will not only answer today’s questions but also flag upcoming changes before they disrupt workflows.

- Privacy-first design → Features like federated learning will ensure sensitive data stays local while still improving accuracy.

- Seamless integration → Assistants won’t sit apart from workflows; they’ll be embedded directly into the tools accountants already use.

- Global reach → As platforms scale, assistants trained on one market’s regulations will adapt to new geographies with minimal friction.

TaxWorld’s expansion into new markets shows how quickly momentum can build. But the larger story is this: AI is becoming a standard part of professional tax practice, not a niche experiment.

The firms that embrace it now will be the ones defining how the profession looks in five years.

FAQs

Does AI replace tax professionals?

No. AI tax assistants handle routine lookups and surface citations instantly, but judgment, interpretation, and client strategy still require human expertise. AI amplifies professionals rather than replacing them.

Is AI tax software reliable enough for compliance?

Yes, when grounded in verified legal sources. The most effective AI tax tools provide source-backed answers, reducing the risk of error and strengthening audit readiness.

What kind of firms benefit most from AI in tax?

Both small and large firms benefit. Smaller practices gain leverage by saving hours of manual research, while larger firms reduce bottlenecks across multiple teams.

How fast can AI tax assistants be deployed?

Modern no-code platforms allow pilots to be set up in weeks and scaled in under a quarter—much faster than traditional software rollouts.

What are the biggest limitations of AI in tax?

Ambiguity in language, jurisdictional differences, and data freshness remain challenges. That’s why oversight from experienced professionals is always essential.

Conclusion: The Future Is Human + AI

Tax research is no longer a quiet back-office task—it’s the frontline of client trust and firm efficiency. Traditional methods can’t keep up with today’s speed, volume, and complexity, but AI is changing that.

By grounding answers in trusted sources, surfacing them instantly, and freeing professionals to focus on higher-value work, AI tax solutions are becoming the new baseline for modern firms.

The lesson is clear: this isn’t about replacing expertise, but about pairing it with a tool that removes bottlenecks and builds capacity.

Just as spreadsheets became indispensable decades ago, AI tax assistants are on track to become the next essential platform—shaping a future where accuracy, speed, and strategy go hand in hand.

Want to see what this looks like in practice? Read the full case study on how TaxWorld scaled with AI!

Transform tax compliance with AI tax solution!

Cut errors, reduce costs, and streamline tax processes using an AI built for accuracy.

Trusted by thousands of organizations worldwide