The ROI of affiliate marketing is one of the most important metrics for anyone running an affiliate program. It doesn’t just tell you if your campaign is making money — it reveals whether your time, energy, and budget are being invested wisely.

In fact, many marketers make the mistake of focusing only on traffic or clicks, without asking the bigger question: Are these efforts actually profitable?

Make Money With AI

Join our Partner Programs!

Boost your reputation, drive revenue and grow your business with CustomGPT.ai.

Understanding ROI is like putting on a pair of clear glasses in a data-heavy world. It cuts through the noise of vanity metrics and shows you the true financial impact of your strategy.

Whether you’re a beginner running your first campaign or an experienced marketer optimizing at scale, learning how to calculate ROI will help you make smarter decisions, avoid waste, and grow long-term profitability.

What is ROI in Affiliate Marketing?

The ROI of affiliate marketing stands for Return on Investment. In simple terms, it measures how much profit you make compared to how much you spend.

It’s a percentage that answers the question: “For every dollar I put into my affiliate program, how much do I get back?”

For example, if you spend $1,000 on affiliate commissions, tools, and ads, and generate $1,500 in sales, your ROI is 50%. That means your program is not only covering costs but also generating profit.

It’s important to understand that ROI is different from other metrics like ROAS (Return on Ad Spend).

While ROAS looks only at revenue versus ad costs, ROI takes into account all expenses — commissions, tools, content production, and even hidden costs like fraud detection or platform fees. This makes ROI a more complete and accurate measure of profitability.

In short, ROI is the number that tells you if your affiliate program is truly working, or if it’s just keeping you busy without building sustainable profit.

Defining ROI in Affiliate Marketing

Return on Investment (ROI) in affiliate marketing hinges on accurately capturing both direct and indirect costs—a nuance often overlooked. While the formula

ROI = (Net Profit ÷ Total Investment) × 100

appears straightforward, its application becomes complex when factoring in hidden variables like platform fees, underperforming ad spend, or even the opportunity cost of managing low-value affiliates.

This precision matters because ROI is not just a profitability metric; it’s a diagnostic tool.

Step 1: Identify Your Total Revenue

To calculate the ROI of affiliate marketing, the first step is to determine how much revenue your program is generating. This might sound simple, but revenue can come from different streams depending on the type of business and affiliate program.

Types of Revenue You Should Count:

- Direct Sales: Purchases made directly from affiliate links.

- Recurring Revenue: Subscription renewals, memberships, or SaaS payments that affiliates helped generate.

- Upsells and Cross-Sells: Extra products or services customers buy after the initial purchase.

- Lead-Generated Revenue: In cases where affiliates bring in qualified leads that later convert.

Example:

If your affiliates bring in:

- $8,000 from direct sales

- $2,000 from recurring subscriptions

- $1,000 from upsells

Your total revenue would be $11,000.

It’s important to track all sources of income influenced by affiliates because missing out on one category can make your ROI look smaller than it actually is.

Many beginners make the mistake of only tracking direct sales, but smart affiliates look at the bigger picture.

Step 2: Identify All Your Costs

Once you know how much money your affiliate program is bringing in, the next step is to calculate all of your costs.

This is where many beginners go wrong — they only look at commissions or ad spend and forget about the “hidden” expenses that can eat into profitability. To get an accurate picture of the ROI of affiliate marketing, every cost needs to be included.

Common Costs to Include:

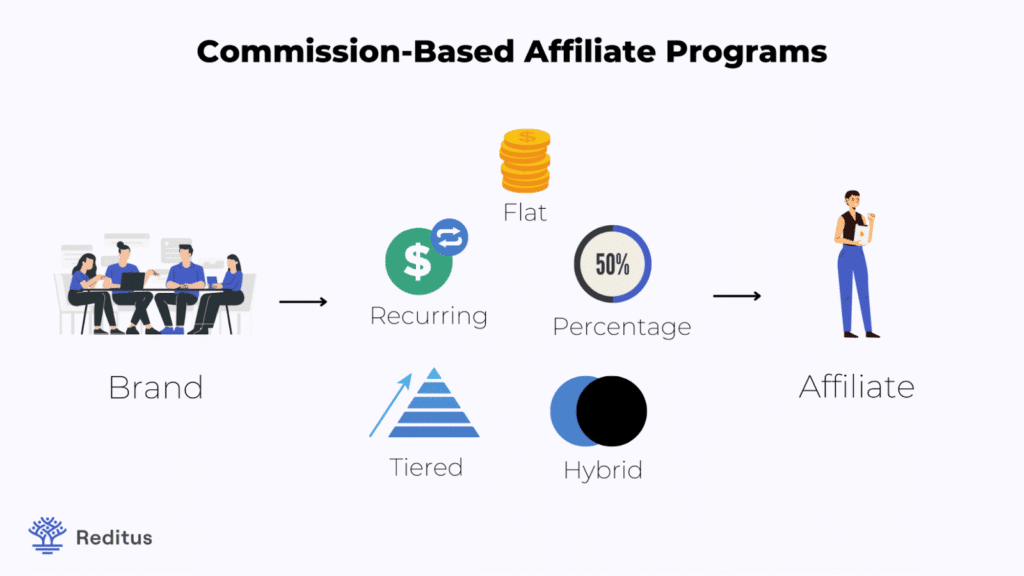

- Affiliate Commissions: The payouts made to affiliates for each sale, lead, or action.

- Advertising Spend: Paid ads you run to drive traffic to affiliate offers.

- Platform or Network Fees: Costs for using affiliate networks or software (e.g., Refersion, Impact, ShareASale).

- Content Creation: Writing, design, or video production to support affiliate promotions.

- Tracking & Analytics Tools: Subscriptions for tools like Google Analytics 4, ClickMeter, or fraud prevention systems.

- Operational Costs: Team salaries, admin tasks, or support services connected to your affiliate program.

Example:

If your campaign costs include:

- $4,000 in affiliate commissions

- $1,500 in ad spend

- $500 in content production

- $500 in software fees

Your total costs would be $6,500.

Remember, underestimating or skipping indirect costs leads to inflated ROI calculations, which can trick you into thinking a campaign is more profitable than it really is.

Step 3: Use the Basic ROI Formula

Now that you know your total revenue and total costs, you can apply the simple ROI formula. The ROI of affiliate marketing is calculated like this:

ROI = (Net Profit ÷ Total Investment) × 100

This formula shows the percentage return on every dollar you invest in your affiliate program.

Example Calculation:

- Revenue: $11,000

- Costs: $6,500

ROI=11,000−6,500/ 6,500 *100 = 69.23%

This means for every $1 spent, the campaign earned $1.69 back — a clear indicator that it’s profitable.

Why It Matters:

The formula looks simple, but it gives you a crystal-clear view of your profitability. Without this number, you might celebrate high sales or traffic without realizing that hidden costs are cutting into your profits.

The key takeaway: ROI is the ultimate health check for your affiliate program.

Step 4: Refine with Extra Metrics

While the basic ROI formula gives you a snapshot, it doesn’t always tell the full story.

To truly understand the ROI of affiliate marketing, you need to refine your calculations with supporting metrics that reveal the quality of your traffic and the long-term value of your customers.

Key Metrics to Include:

- Average Order Value (AOV): Shows how much each customer spends per transaction. Higher AOV means better profitability without necessarily increasing traffic.

- Customer Lifetime Value (CLV): The total revenue a customer generates over their relationship with your brand. Affiliates who bring in high-CLV customers are more valuable, even if initial sales are smaller.

- Cost Per Acquisition (CPA): How much it costs you to acquire one customer. Comparing CPA to CLV helps determine if your investment is sustainable.

- Earnings Per Click (EPC): Measures how much revenue each click generates on average. Useful for comparing affiliates or campaigns.

Example:

Suppose your affiliate campaign generates customers with:

- AOV: $100

- CLV: $500

- CPA: $120

Even if the first purchase looks only moderately profitable, the long-term CLV shows that each customer brings in much more revenue over time. This makes the campaign far more profitable than the basic ROI suggests.

Why This Step Matters:

By layering in these metrics, you go beyond short-term wins and start identifying affiliates and campaigns that deliver sustainable, long-term growth.

Step 5: Adjust for Time and Campaign Type

The ROI of affiliate marketing is not a one-size-fits-all calculation. Campaigns often involve different timelines, customer behaviors, and revenue models, which means you need to adjust how you measure profitability.

Time Factor

Some campaigns generate immediate revenue, while others pay off over months or even years. For example:

- E-commerce: ROI may be visible within days or weeks because sales happen quickly.

- SaaS or Subscription Programs: ROI may take months to show up as recurring revenue builds over time.

To account for this, marketers often use Net Present Value (NPV) to discount future revenue and understand its current worth. This avoids overestimating long-term income.

Campaign-Specific Factors

- Seasonal Campaigns: Holiday-focused promotions might show high ROI in December but little impact afterward.

- High-CLV Products: Some affiliates bring fewer customers but with higher lifetime value, making them more profitable long-term.

- Trial-to-Paid Conversions: In SaaS, free trial users may not convert right away, so ROI calculations need to extend beyond initial signups.

Why This Step Matters

If you only look at short-term results, you might mistakenly shut down campaigns that are actually profitable over time. Adjusting ROI for time and campaign type gives you a clearer, more realistic picture of performance.

Common Mistakes Beginners Make

Calculating the ROI of affiliate marketing seems simple, but many beginners fall into the same traps that distort results and lead to bad decisions.

- Ignoring Indirect Costs: New marketers often count only commissions or ad spend while forgetting about fees for platforms, content creation, or tracking tools. This inflates ROI and gives a false sense of profitability.

- Focusing Only on Short-Term Results: Some campaigns, especially in SaaS or subscription models, take months to show their true value. Beginners may cut campaigns too early because they only look at immediate sales.

- Confusing ROI with ROAS:Return on Ad Spend (ROAS) only measures revenue against ad costs, while ROI includes all costs. Mixing these metrics can make campaigns look healthier than they are.

- Not Tracking Customer Lifetime Value (CLV): A customer who buys once may look profitable at first, but if they never return, the long-term ROI suffers. Ignoring CLV hides the real winners among affiliates.

- Over-Relying on Clicks: High traffic or click-through rates (CTR) don’t guarantee profit. Without conversions and revenue, clicks are just vanity metrics.

- Poor Data Attribution: Using last-click attribution alone overlooks the role of mid-funnel interactions, like blogs or email sequences. This undervalues affiliates who nurture prospects before the final purchase.

Each of these errors makes ROI numbers misleading, which can cause wasted ad spend, misaligned commission structures, and missed opportunities with high-performing affiliates.

Pro Tips for Improving ROI

Once you’ve avoided the common mistakes, the next step is learning how to maximize the ROI of affiliate marketing. These strategies help you get more profit out of every dollar spent.

- Segment Affiliates by Performance: Not all affiliates are equal. Separate them by metrics like conversion rate, EPC (earnings per click), or CLV of the customers they bring in. Invest more in affiliates who drive long-term, high-value customers.

- Use Multi-Touch Attribution: Switch from last-click attribution to multi-touch models. This way, you can see how blog posts, email campaigns, and retargeting ads all contribute to conversions — ensuring that affiliates are rewarded fairly.

- Optimize Landing Pages: A poorly optimized landing page kills ROI, no matter how good the traffic. Use A/B testing, heatmaps, and clear CTAs to turn clicks into conversions.

- Reinvest in What Works: Don’t spread your budget too thin. Double down on the campaigns, content, and affiliates already showing strong returns. This creates a compounding effect on ROI.

- Track Beyond Sales: Measure not just sales but also repeat purchases, upsells, and subscription renewals. These often hold the key to long-term profitability.

- Leverage Automation & AI Tools: Use platforms like CustomGPT.ai or analytics dashboards to unify data and automate tracking. Automation reduces errors, saves time, and ensures you never miss key profitability signals.

Improving ROI isn’t just about cutting costs — it’s about smarter allocation of time and resources. By focusing on data-driven decisions, you can turn good campaigns into great ones.

FAQ

What is the difference between ROI and ROAS in affiliate marketing?

ROI measures overall profitability by including all costs (commissions, tools, content, etc.), while ROAS focuses only on revenue vs. ad spend. ROI gives the bigger picture, while ROAS is narrower.

How do indirect costs like platform fees affect ROI?

Indirect costs, such as software fees or content creation, reduce profitability. Ignoring them inflates ROI and can lead to overspending on campaigns that aren’t truly efficient.

What metrics should I track to calculate ROI correctly?

Track revenue, total costs, average order value (AOV), customer lifetime value (CLV), and cost per acquisition (CPA). These give you the most accurate picture of performance.

How does multi-touch attribution improve ROI measurement?

It spreads credit across the entire customer journey — not just the first or last click. This highlights the value of mid-funnel content like blogs or emails, giving a fairer view of affiliate contributions.

Why is Customer Lifetime Value (CLV) important in ROI?

CLV shows the total revenue a customer brings over time. Affiliates who deliver high-CLV customers may look less profitable upfront but drive stronger ROI long-term.

Conclusion & Call to Action

Measuring the ROI of affiliate marketing isn’t just about crunching numbers — it’s about making smarter decisions with your time, money, and partnerships.

When you understand exactly which affiliates, campaigns, and strategies are paying off, you can double down on what works and cut what doesn’t. That clarity is what separates profitable programs from the ones that stall.

If you want a head start, CustomGPT.ai makes it easier. Not only can you leverage powerful AI insights for tracking and optimizing campaigns, but you can also join their affiliate program and earn up to 20% recurring commissions for two years.

👉 Sign up for the CustomGPT.ai Affiliate Program and start turning your ROI insights into real profit.