In tax, expertise has never been the problem—time has. Every year brings thousands of regulatory updates, hundreds of new rulings, and clients who expect answers faster than ever.

For small and mid-sized firms, keeping pace without burning out staff or losing clients has become a pressing challenge.

Artificial intelligence is starting to change that equation.

AI for tax professionals are giving professionals the ability to handle research at scale—quickly surfacing the source-backed answers, reducing repetitive work, and creating more space for strategic judgment.

This playbook looks at how AI is helping firms scale their expertise.

We’ll cover the new demands on tax professionals, what modern AI assistants can (and can’t) do, and how one lean firm, TaxWorld, used AI to turn a research bottleneck into a growth engine.

The New Reality for Tax Professionals

Tax research has always been time-intensive, but in today’s environment it has become nearly unmanageable. Regulations shift constantly, interpretations pile up, and clients expect near-instant clarity.

What once took days of careful reading now has to be delivered in hours—or even minutes.

Over half of accounting professionals report that technology has significantly improved client communication and responsiveness (CPA.com & BILL Growth & Technology Survey, 2023).

Yet, many still struggle with the sheer volume of information to process before they can provide answers, highlighting the growing gap between available tools and daily demands.

The reality shows up in three pressure points:

- Information overload: Thousands of updates every year, scattered across databases, portals, and PDFs.

- Client expectations: A Professional Adviser report notes that clients increasingly expect 24/7 digital access, often through digital channels such as mobile apps with real-time updates. These expectations now extend to tax queries, where digital tools must complement human interaction.

- Capacity crunch: Smaller firms without dedicated research staff feel the squeeze most, losing valuable billable hours to routine queries.

The paradox is clear: expertise has never been higher, but the systems built to support it have become bottlenecks.

Firms aren’t struggling with knowledge—they’re struggling with scale. The outcome is simple, the firms that can’t meet this demand risk appearing outdated, no matter how strong their technical expertise.

The New Demands on Tax Practices

The nature of tax work hasn’t changed—accuracy, compliance, and trust remain the cornerstones. What has shifted is the pace and scale at which professionals are expected to deliver.

Today’s tax practices are facing a new set of demands:

- Real-time clarity: Clients expect answers while they’re still in the meeting, not days later.

- Capacity without expansion: Smaller firms don’t have the luxury of adding teams of researchers. They need to scale output without inflating headcount or costs.

- Audit-ready rigor: Every recommendation must not only be accurate but also traceable back to primary sources—whether for regulatory reviews or client trust.

- Competitive parity: Large firms are already investing in advanced research platforms. For smaller practices, failing to adopt new tools risks widening the competitive gap.

The message is clear: doing more with less is no longer optional—it’s survival. And that’s where the rise of AI for tax professionals begins to reshape the profession.

What an AI for Tax Professionals Really Does

When people first hear about AI in tax, the image can swing between extremes: either a sci-fi vision of robots replacing accountants or marketing buzz promising a “magic button.” The reality is far more grounded—and far more practical.

An AI tax assistant is not a replacement for expertise. Instead, it acts as a research partner, handling the heavy lifting of search, organization, and source validation so professionals can focus on interpretation and judgment.

Here’s what that looks like in practice:

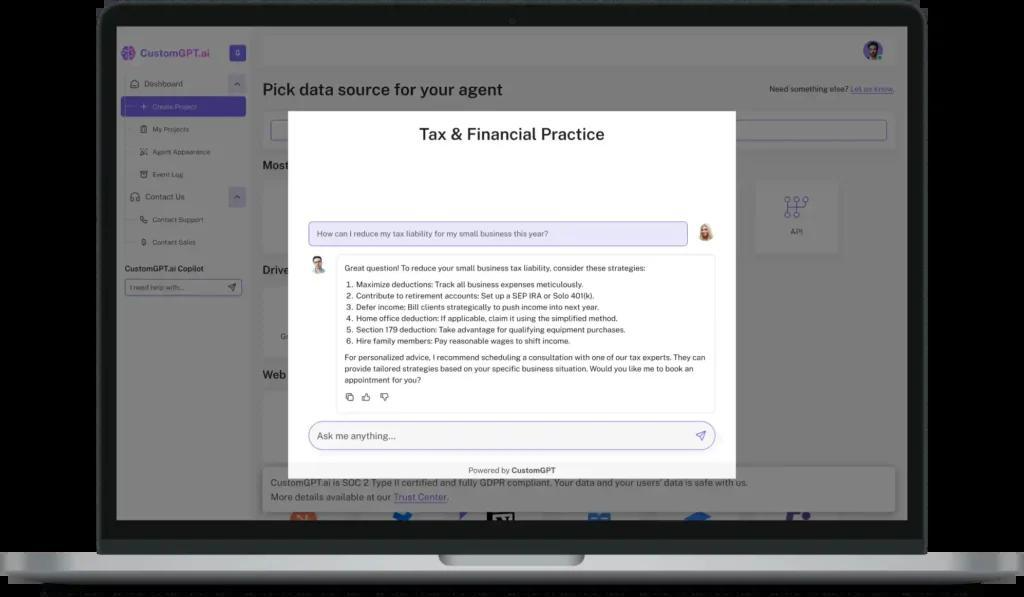

- Natural-language research: Instead of combing through databases, professionals can type a question in plain English—“Does this ruling apply to pass-through entities in New York?”—and receive an answer with direct citations to source law.

- Source-backed citations: The assistant doesn’t invent answers. It pulls citations directly from trusted regulations, case law, or firm-specific knowledge bases, providing links to verify every response.

- Consistency at scale: Because the system draws from a centralized and continuously updated knowledge base, results don’t vary by researcher—everyone works from the same foundation.

- Time savings: What once took hours can be reduced to minutes, freeing up capacity for higher-value tasks like advisory, planning, and client engagement.

- Error reduction: Automated cross-checking ensures that overlooked rulings or outdated references don’t creep into final answers.

The key is partnership. Just as spreadsheets didn’t replace accountants but made their work faster and more accurate, AI for tax professionals amplifies professionals without sidelining them.

They help meet the new demand: answers that are faster, consistent, and verifiable—without sacrificing the judgment and nuance only humans can bring.

Meet TaxWorld: A Lean Startup with a Big Mission

TaxWorld is a fast-growing fintech company serving small and mid-sized accounting firms. Based in Ireland and expanding across the UK, they’ve built their reputation on trust, usability, and depth of expertise in the legal-tax space.

Their mission: to make accurate, accessible tax research available to firms with fewer than ten employees—firms often left behind by heavyweight incumbents.

But ambition alone wasn’t enough. The reality on the ground was tough:

- Time-intensive research was eating into billable hours. A single client query could require hours of manual lookups.

- Fragmented sources created inconsistency. Legislation, case law, and tribunal decisions were scattered across multiple systems, increasing the risk of missed or conflicting interpretations.

- Unaffordable incumbents like Tolley in the UK dominated the market with comprehensive but expensive tools—priced and designed for large firms, not lean practices.

- Client expectations were shifting. Waiting days for answers was no longer acceptable when businesses expected near-instant clarity backed by reliable sources.

For smaller firms, this combination created a research bottleneck: expertise was there, but scaling it fast enough to meet demand wasn’t possible with traditional tools.

How CustomGPT.ai Helped TaxWorld Break the Bottleneck

For TaxWorld, the turning point came with CustomGPT.ai, a no-code AI platform that let them launch a tax assistant without hiring engineers or building software from scratch.

Here’s how it worked:

- Integrate thousands of documents: Ezylia was connected to legislative updates, tribunal decisions, and case law through 100+ one-click data integrations supporting 1,400 file types.

- Trusted Answers with Citations: Built on retrieval-augmented generation (RAG) architecture, every response came with citations, ensuring that accountants could trust the outputs.

- No-Code Simplicity: With zero internal engineering staff, TaxWorld relied on CustomGPT.ai’s plug-and-play integrations to set up a professional-grade tool quickly.

- Seamless Integration: Ezylia was embedded directly into their website, giving accountants an intuitive interface aligned with TaxWorld’s brand.

- Scalable Infrastructure: As usage grew, the AI tax assistant handled increasing volumes of queries—2,000+ per day—without compromising speed or accuracy.

Instead of replacing expertise, the assistant amplified it. Tax professionals could lean on Ezylia for the heavy lifting of research while keeping human oversight for judgment, interpretation, and client communication.

Alan Moore, Founder & CEO, TaxWorld, summarized the impact best:

“CustomGPT.ai let us punch far above our weight. With almost no engineering budget, we built an assistant that now answers tens of thousands of complex tax questions and fuels our revenue growth every month.”

TaxWorld’s Playbook: Steps They Took

What makes TaxWorld’s story valuable isn’t just their results—it’s the practical steps they followed that any firm can learn from. Their journey can be broken down into four clear moves:

- Define the bottleneck clearly: TaxWorld realized their biggest pain point wasn’t expertise—it was time. Accountants knew the answers, but dense legislation and scattered case law made every query a costly research project.

- Pick a tool that matched their size: Instead of expensive, heavyweight platforms, they chose a no-code assistant builder (CustomGPT.ai) that could be launched without developers or large budgets. The priority was speed to value, not a long IT roadmap.

- Connect the right data first: They didn’t try to feed Ezylia “everything” at once. Instead, they prioritized connecting legislation, tribunal decisions, and case law—the highest-value sources their clients needed daily.

- Build trust with citations: TaxWorld knew accountants wouldn’t rely on black-box answers. By ensuring every output included a citation to the underlying source, they made Ezylia not just fast but credible.

- Scale with confidence: With Ezylia handling more than 2,000 queries per day and 97.5% answered successfully, TaxWorld could expand into new markets knowing their infrastructure and processes would keep pace.

This simple but focused playbook turned what was once a research bottleneck into a repeatable growth engine.

Results: What Changed at TaxWorld

For TaxWorld, the impact of Ezylia wasn’t incremental—it was transformative.

- Query handling at scale: In its first phase, Ezylia answered more than 189,000 tax questions, with 97.5% handled successfully. Instead of spending hours cross-referencing rulings, accountants now get instant, citation-backed answers.

- Time reclaimed: The assistant saves TaxWorld’s users more than 500 hours per week, freeing professionals to spend more time on strategy and client relationships.

- Revenue growth unlocked: By scaling their expertise without adding headcount, TaxWorld achieved 200% year-over-year growth in recurring revenue, doubling their ARR to nearly €1 million in just two years.

- Expanding user base: With 740 paying subscribers and only eight cancellations since launch, adoption rates signal both trust and stickiness.

- Daily scale: Today, Ezylia handles 2,000+ tax queries every single day, demonstrating that small firms can achieve enterprise-grade efficiency.

- Built-in learning: Answers from TaxWorld’s human-led Q&A forum feed directly into Ezylia, ensuring that the system grows smarter with every interaction.

Together, these results show how a lean startup used AI not just to keep up with client expectations, but to leapfrog incumbents—proving that small firms with the right tools can scale like enterprise players.

Why It Worked

TaxWorld’s success wasn’t luck—it came from making smart choices about how to implement AI in a high-stakes, accuracy-driven field. Several factors made Ezylia a practical and trusted assistant from day one:

- Founder-led deployment: Because CustomGPT.ai required no engineering resources, TaxWorld’s leadership could prototype, refine, and launch Ezylia themselves, without long development cycles.

- No-code simplicity: A small, non-technical team could configure and scale the assistant quickly, avoiding the overhead and delays that come with traditional software projects.

- Trusted, citation-backed answers: Every response pointed back to the original legislation or case law, eliminating “black box” outputs and giving accountants confidence to use answers directly in their work.

- Data security built in: With proprietary legal data at the core of their business, TaxWorld needed full control. CustomGPT.ai ensured data stayed private—no leakage, no retraining risks.

- Scalable infrastructure: From day one, Ezylia could handle thousands of queries per day without performance issues, giving the team confidence to expand into new markets.

- Human + AI loop: By integrating insights from their community Q&A forum directly into Ezylia, TaxWorld created a virtuous cycle where the assistant got smarter with every new interaction.

The combination of lean execution, airtight trust, and real scalability allowed TaxWorld to grow faster than firms many times their size—without compromising the accuracy that clients demand.

The Future of Expertise in Tax

TaxWorld’s success is not an isolated story. It reflects a wider shift in the profession: firms of all sizes are beginning to view AI for tax professionals as essential infrastructure, not experimental add-ons.

Three trends are already shaping what comes next:

- AI as a competitive equalizer: Smaller firms can now match the research capabilities of larger competitors without needing large back-office teams.

- Expansion across jurisdictions: Assistants trained on one market’s legislation can adapt quickly to new geographies, giving firms confidence to scale internationally.

- From reactive to proactive: Instead of waiting for regulations to overwhelm staff, AI tools for tax professionals will increasingly flag changes and recommend adjustments before clients even ask.

For tax professionals, the takeaway is simple: AI isn’t just about efficiency, it’s about resilience. Firms that adopt it thoughtfully will not only deliver faster answers but also earn trust and expand their capacity for higher-value advisory work.

FAQs

Does AI replace tax professionals?

No. AI amplifies expertise, it doesn’t replace it. AI assistants handle the repetitive, time-intensive tasks like searching through legislation or cross-referencing rulings. Professionals remain essential for interpretation, judgment, and advising clients.

What is a “no-code” AI assistant for tax, and why does it matter?

A no-code assistant means tax professionals (or small firm teams) can configure AI tools—connect sources, write prompts, set up interfaces—without needing engineering support. This reduces cost, implementation time, and dependency on IT teams.

How does AI handle tax law updates or changes?

Good AI tax assistants use frameworks that allow quick ingestion of updated legislation, tribunal decisions, or rulings. Some use version control or retrieval-augmented generation (RAG) so the system points to the newest, authoritative sources. Human monitoring is essential to catch edge cases or ambiguous changes.

Could using AI tax assistants expose firms to legal or compliance risks?

Potentially, yes. If the tool isn’t properly grounded in law, citations are missing, or the data used is outdated. That’s why firms must choose tools that ensure audit trails, secure data practices, and offer transparency in how the AI makes decisions.

What kinds of tax queries are best suited for AI tax assistants?

Routine, high-volume questions (common scenarios, tax forms, legal definitions, jurisdiction comparisons) are where AI shines. Edge-case or highly specialized questions still benefit from human review or paired AI + expert workflows.

What if AI gives the wrong answer?

That’s why human oversight is key. AI should be treated as a first-pass researcher, surfacing grounded answers in seconds. Professionals must still validate and apply judgment, especially in ambiguous or high-stakes scenarios.

Conclusion: Scaling Expertise Without Scaling Teams

Tax research will only get more complex. Clients expect instant, accurate answers, and smaller firms can no longer afford to lose hours chasing rulings or cross-referencing PDFs. TaxWorld shows that with the right AI partner, even a lean startup can deliver enterprise-grade expertise—without a large research team or heavy IT spend.

Ezylia, their AI tax assistant powered by CustomGPT.ai, now handles thousands of queries daily, drives 200% YoY growth, and frees 500+ hours per week for client-focused work. It’s proof that AI doesn’t replace expertise—it scales it.

For firms weighing how to adapt, the lesson is clear: the tools exist to meet rising client expectations without burning out staff or breaking the budget. The question isn’t whether AI will reshape tax—it already is.

The real question is how quickly firms choose to adapt.

Want to see the full story of how TaxWorld scaled with AI? Read the full case study here!

Turn complex tax work into simple AI workflows!

Boost accuracy, save time, and scale expertise with AI for tax professionals.

Trusted by thousands of organizations worldwide