For decades, tax professionals have worked under constant tension: the need for absolute accuracy versus the pressure for faster turnaround.

Each filing season brings more regulatory complexity, more client demands, and greater strain on already stretched teams. This is where AI tools for tax professionals are beginning to shift the equation.

Instead of losing hours chasing citations across fragmented databases, modern AI tax solutions surface source-backed answers instantly, reduce repetitive lookups, and help maintain compliance with confidence.

For firms competing in an environment where expectations rise daily, the right tools don’t just save time—they protect credibility and strengthen client trust.

The Growing Challenges for Tax Professionals

For decades, tax professionals have balanced two competing demands: accuracy and efficiency. But the balance has tipped. Regulatory complexity and client expectations are rising faster than traditional methods can handle.

Three challenges stand out:

- Volume of updates: The U.S. tax code alone sees thousands of changes each year. A 2023 Tax Policy Center report highlighted that over 1,200 federal tax updates were recorded annually, not including state-level changes.

- Fragmented resources: Critical information is spread across multiple databases, case law archives, and firm-specific notes. Professionals often spend hours piecing together citations from inconsistent sources.

- Rising client expectations: Clients no longer accept “I’ll get back to you next week.” A recent Wolters Kluwer survey found that 73% of firms report technology is improving their average client response time.

The outcome is predictable: smaller firms are losing ground, not because they lack expertise, but because navigating an overwhelming and fragmented knowledge base consumes the one resource no firm can spare—time.

Volume and Velocity: Why Traditional Research Struggles

The tax landscape isn’t just complex — it’s constantly expanding and shifting. Professionals are expected to interpret massive volumes of information while keeping pace with a rate of change that legacy research systems simply weren’t built to handle.

The Scale of Modern Tax Codes

The U.S. tax code spans more than 6,800 pages in statutory form (IRS Reading, 2024). Add in IRS regulations, rulings, and administrative guidance, and the body of tax law grows even larger.

For professionals, the challenge multiplies when reconciling state rules with international frameworks like OECD guidelines.

The result is a research burden where even minor oversights can cascade into compliance risks.

The Velocity of Change

If volume weren’t enough, tax laws also evolve at breakneck speed. A report (2023) found that in just one year, more than 1,000 tax-related legislative changes were enacted globally.

Traditional tools rely on periodic database updates — and they often lag. That delay means professionals may work with outdated information, a serious risk in compliance-driven environments.

These pressures compound over time, making it harder for firms to deliver consistent, reliable answers.

Why Manual Systems Can’t Keep Pace

Legacy systems and manual processes are ill-equipped for this environment. Keyword-based searches rarely capture the contextual relationships between statutes, rulings, and case law.

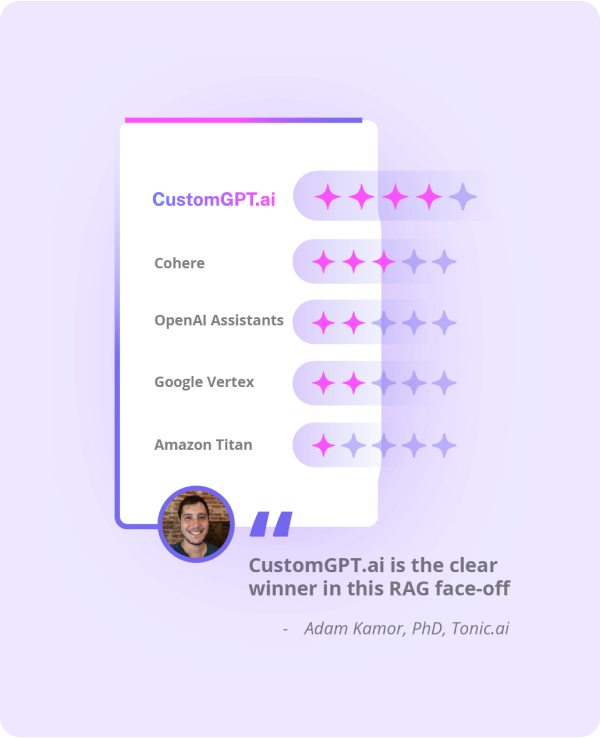

By contrast, AI tools for tax professionals, particularly modern AI tax software, use vector search and retrieval-augmented generation (RAG) to surface contextually relevant, source-backed answers in real time.

This ensures professionals can work with the latest updates while reducing the likelihood of missed provisions.

The Hidden Costs of Manual Research

The challenges above don’t just create extra work — they ripple across a firm’s entire operation. Manual processes carry hidden costs that quietly erode profitability, client trust, and growth potential.

The strain shows up in three ways:

Lost Time and Revenue

Every hour spent piecing together citations is an hour not spent advising clients or growing the practice. For small and mid-sized firms, these inefficiencies add up quickly, cutting directly into profitability.

Inconsistent Answers

With critical information spread across fragmented tools and archives, even seasoned professionals risk producing answers that vary from one researcher to the next.

This inconsistency not only undermines client confidence but also increases exposure to compliance errors.

Stalled Growth

When research bottlenecks slow service delivery, firms struggle to scale. Teams spend more time reacting to queries and less time on strategic growth initiatives. For many firms, this becomes a ceiling on growth.

The message is clear: the real barrier isn’t expertise. It’s the hidden cost of relying on outdated processes instead of adopting AI tools for tax professionals.

Modern AI tax software transforms research from a liability into a scalable, compliant process — allowing firms to keep pace with both regulation and client expectations.

The Evolution of Tax Software

Tax software has come a long way from basic calculators and filing tools. Early platforms could only automate forms, leaving professionals with the heavy lifting of research and compliance.

Today’s AI tools for tax professionals go much further, offering adaptive features that keep pace with fast-changing regulations and complex queries.

A 2025 Thomson Reuters Institute report found that firms integrating generative AI into their tax workflows significantly improved both the accuracy and speed of research, helping professionals meet client expectations for real-time guidance (source).

Key Shifts in Modern Tax Software

- From rule-based to adaptive: Older systems relied on rigid if-then rules. AI-driven tools now adapt dynamically, identifying patterns in filings, regulatory changes, and client data.

- Smarter Document Handling: Optical character recognition (OCR) has evolved beyond text capture. New systems classify, extract, and organize information, turning scanned returns or rulings into structured data ready for analysis.

- Audit-ready by design: Features like version control and automated citations create transparent trails regulators can trust.

- Integration first: APIs connect AI tax software directly with practice management and e-filing systems, eliminating redundancy.

How AI Tools for Tax Professionals Transform Research

Tax professionals are no strangers to complex workflows. But the combination of sheer volume and constant updates has pushed traditional research methods beyond their limits.

This is where modern AI for tax professionals comes in. Instead of relying on static databases and manual cross-checks, these systems use advanced techniques like vector search and retrieval-augmented generation (RAG) to deliver precise, source-backed insights in real time.

From Keyword Search to Contextual Understanding

Traditional research tools depend heavily on keyword matching. The problem? Legal language is nuanced, and the same concept can be expressed in multiple ways across jurisdictions.

AI tax software uses vector search to interpret the meaning of queries and map them to statutes, rulings, and case law.

This means a tax professional researching corporate deductions under both state and federal law can receive contextually relevant results without spending hours cross-referencing.

Retrieval-Augmented Generation (RAG) in Action

Beyond finding documents, AI can generate answers that are anchored in trusted sources. With RAG, the system retrieves the most relevant regulations or rulings, then generates a response that includes citations directly tied to those texts.

This doesn’t just improve speed — it builds compliance confidence by ensuring every output is verifiable.

As Dr. Alan Hughes, a compliance strategist, explains:

“AI doesn’t replace judgment — it amplifies it by eliminating noise and surfacing actionable insights.”

Building Trust Through Transparency

One of the biggest concerns in AI for tax is accuracy. Professionals cannot risk relying on unsupported or “hallucinated” outputs.

That’s why leading systems emphasize audit-ready transparency: every answer includes a citation trail, making it easy for accountants to validate results.

For firms in highly regulated environments, this transforms AI from a novelty into a trusted daily tool.

Practical Applications of AI in Tax Research

Understanding how AI works is one thing — but the true value emerges when you see how these tools fit into day-to-day workflows.

Modern AI tools for tax professionals aren’t abstract concepts; they’re practical systems that directly address the bottlenecks firms face in research, compliance, and client service.

Automated Data Extraction and Tax Code Assignment

Rather than reviewing statutes, rulings, or case law manually, AI-driven platforms use natural language processing (NLP) to extract entities like dates, thresholds, or jurisdictional references and map them to relevant tax code provisions.

This shifts professionals’ effort from manual parsing to review and verification, often saving hours per task.

Risk Detection and Anomaly Highlighting

Some AI tax software platforms now offer features that assist with risk detection: spotting discrepancies or patterns in past filings, or highlighting potential conflicts in interpretations.

Real-Time Regulatory Updates and Monitoring

One of the biggest frustrations in tax research is lagging behind new laws or rulings. AI tools can help by integrating real‐time or frequent updates from legislative, regulatory, and case law sources so that research reflects current regulatory environments.

This reduces the chance of working with outdated or obsolete information which is a key compliance risk.

Simplifying Cross-Jurisdictional Research

For firms handling clients or operations across states or internationally, reconciling overlapping statutes, federal/state differences, or international guidance is a big hurdle.

AI tools help by surfacing relevant rules from each jurisdiction, flagging notable overlaps or conflicts, and thus shortening the time needed to perform comparative or cross-border research.

Real-World Example: Turning Research Overload Into Growth

The research bottleneck isn’t just theoretical. One lean startup, TaxWorld, shows how smaller firms can flip the problem into an opportunity.

TaxWorld set out with a simple mission: make accurate, trusted tax guidance available to small accounting practices that lacked the resources of top-tier firms.

Without an internal engineering team and working on a lean budget, they needed a way to deliver expert-level research at scale.

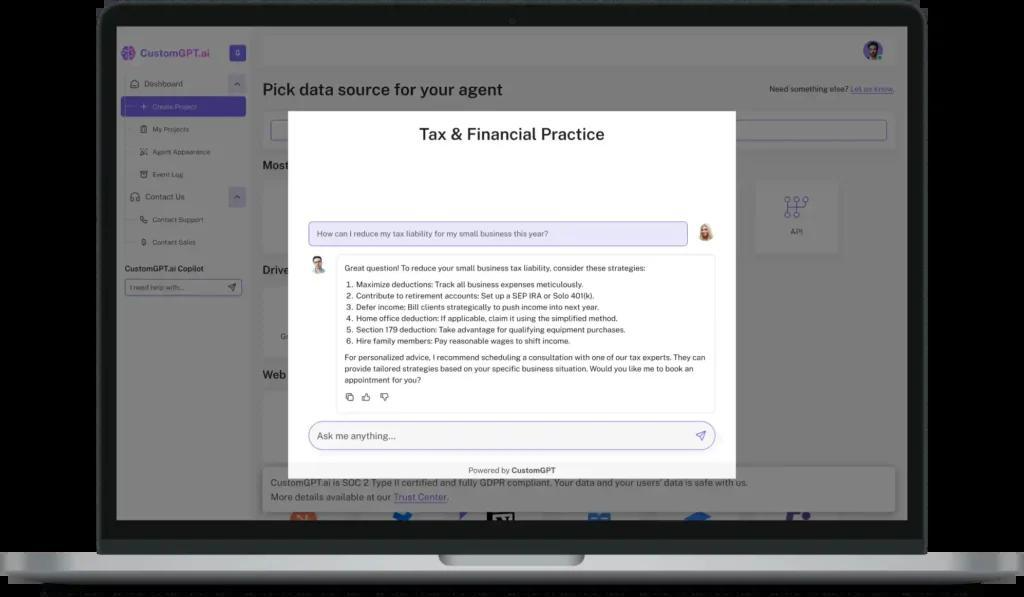

Their answer was Ezylia, an AI tax assistant built on CustomGPT.ai.

By connecting Ezylia to thousands of legislative documents, tribunal decisions, and case law, TaxWorld created a tool that could provide citation-backed answers in seconds—something their users previously spent hours chasing across fragmented resources.

The results speak for themselves:

- 97.5% of queries handled successfully.

- 200% YoY revenue growth, doubling ARR to nearly €1m in just two years.

- 500+ hours saved per week for firms using the platform.

- 2,000+ daily queries answered with high accuracy.

- 740 paying subscribers, with only eight cancellations since launch.

As Founder & CEO Alan Moore explained:

“CustomGPT.ai let us punch far above our weight. With almost no engineering budget, we built an assistant that now answers tens of thousands of complex tax questions and fuels our revenue growth every month.”

What made it work wasn’t just the technology, but how it was deployed: no-code simplicity allowed fast iteration, citation-backed answers built trust, and secure infrastructure scaled seamlessly as the firm expanded into the UK and US.

👉 Read the TaxWorld the full case study.

Benefits Beyond One Firm

What happened at TaxWorld isn’t an isolated success story. It’s a glimpse into what’s possible when tax professionals embrace AI tools not just as software, but as everyday partners in their work.

Time and Cost Savings

Think about the hours a small firm spends chasing down answers across fragmented databases. Now imagine cutting those hours into minutes. For many firms, that means extra time for billable client work instead of lost weekends spent buried in case law.

The shift doesn’t just save money — it transforms how professionals plan their days.

Accuracy and Compliance

Every professional knows the weight of responsibility that comes with giving tax advice. A small misstep can cascade into penalties or client disputes. AI assistants that provide citation-backed answers turn guesswork into certainty.

Instead of double-checking across multiple sources, professionals can see the reference instantly, reducing errors and improving compliance.

Scalability for Growing Firms

For firms on the move, scaling is often the biggest hurdle. Adding clients typically means adding staff, training, and overhead. AI changes that equation.

Just as TaxWorld expanded to handle thousands of daily queries without a large research team, other firms can scale their expertise without ballooning their costs.

Building Client Trust

Clients don’t just want fast answers — they want answers they can trust. When professionals deliver guidance backed by a direct source, it creates confidence. The firm looks modern, reliable, and client-centered.

In an industry built on trust, that’s a competitive advantage that goes beyond technology.

Overcoming AI Adoption Challenges

Even with the promise of AI tools for tax professionals, adoption isn’t without hurdles. For firms considering implementation, three challenges stand out:

- Human-in-the-Loop Is Essential: AI can surface insights quickly, but tax is a high-stakes field. Professionals must validate outputs, especially in edge cases or ambiguous filings. The most effective systems are those designed to complement—not replace—expert judgment.

- Data Quality Determines Accuracy: AI is only as good as the content it’s grounded in. If regulations are outdated or fragmented, results will reflect that. Successful firms curate their source material carefully and regularly update their datasets.

- Safeguarding Security and Privacy: With sensitive financial data at stake, compliance with frameworks like GDPR and SOC 2 isn’t optional. Role-based access controls, audit trails, and transparent version histories ensure both client trust and regulatory adherence.

Together, these measures turn potential risks into guardrails, ensuring that AI adoption strengthens rather than undermines a firm’s credibility.

Advanced Capabilities and Future Trends

The latest generation of AI tools for tax professionals goes beyond efficiency gains. These systems are beginning to anticipate, adapt, and even predict regulatory shifts.

- Real-Time Anomaly Detection: Instead of static rules, modern AI models analyze filings dynamically, flagging irregularities such as unusual deduction patterns or income mismatches in real time.

- Global Tax Law Indexing: With multinational clients, firms need instant access to updates across jurisdictions. AI platforms now parse and categorize global legislative changes, surfacing only what’s relevant to a firm’s practice.

- Adaptive, Domain-Specific Models: Unlike general-purpose AI, domain-trained models learn the nuances of tax language and regulation. This ensures greater accuracy in compliance-heavy contexts.

- Predictive Compliance Analytics: AI is starting to shift from reactive research to proactive insight, identifying emerging risks before they impact filings or audits.

The future isn’t about replacing tax professionals with machines. It’s about creating assistants that help firms handle complexity at scale—so professionals can focus on strategy, not document hunts.

FAQs on AI Tools for Tax Professionals

What are AI tools for tax professionals?

AI tools for tax professionals are software platforms that use artificial intelligence — such as natural language processing (NLP) and retrieval-augmented generation (RAG) — to analyze tax codes, rulings, and case law.

Instead of relying on manual searches, they surface source-backed answers in real time, helping firms improve efficiency and compliance.

How is AI used in tax research?

AI is used to automate repetitive research tasks, such as extracting key provisions from statutes, validating citations, and monitoring regulatory updates. By doing so, AI in accounting workflows reduces time spent on manual cross-referencing and helps ensure consistency across answers.

What is the best AI tax software for small firms?

The best AI tax software depends on a firm’s size and needs, but leading solutions emphasize three things: citation-backed accuracy, ease of integration with existing systems, and strong data security.

Can AI replace tax professionals?

No. AI for tax is designed to augment, not replace, professional expertise. These systems handle routine lookups and flag potential conflicts, while tax professionals apply judgment to interpret nuances and resolve edge cases.

Is AI in accounting secure for sensitive client data?

Yes — but only when platforms are built with security in mind. The best AI tax software uses encryption, role-based access, and audit trails to meet compliance standards such as SOC 2 and GDPR, ensuring that sensitive financial information remains protected.

Conclusion: Moving Beyond Research Overload

For decades, tax professionals have shouldered the weight of fragmented databases, time-consuming searches, and the constant pressure of accuracy.

Now, AI tools for tax professionals are rewriting that story. By delivering citation-backed insights, simplifying cross-jurisdictional research, and updating workflows in real time, these platforms transform compliance from a burden into a competitive advantage.

The message is clear: AI in accounting isn’t about replacing expertise — it’s about amplifying it. With the right AI tax software, firms of any size can save time, scale confidently, and strengthen client trust.

👉 Want to see this in action? Read the full TaxWorld case study to learn how a lean startup doubled its revenue and saved 500+ hours per week with an AI tax assistant.

Work faster & smarter with AI tools for tax.

Save time, reduce errors, and deliver better results with powerful AI tools for tax professionals.

Trusted by thousands of organizations worldwide