Tax professionals today are working in an environment that feels like it changes by the hour. Each filing season brings new forms, new updates, and new client expectations.

What once took days of manual research now has to be turned around in hours — and the margin for error keeps getting smaller. This pressure is why so many firms are exploring AI tax software.

These tools are no longer just calculators or filing assistants

They’re becoming research partners, compliance checkers, and time-savers — designed to take the weight of repetitive work off professionals so they can focus on what really matters: judgment, strategy, and client relationships.

But with dozens of tools on the market and features that all sound impressive, one question keeps coming up: what actually makes the best AI tax software, and how do you choose it?

The Search for the Best AI Tax Software

Finding the right AI tax software can feel overwhelming. Every provider promises smarter automation, faster processing, and more accuracy — but the reality is that not all platforms are created equal.

For professionals, the search isn’t about chasing the latest buzzword. It’s about identifying tools that fit seamlessly into existing workflows, keep sensitive data secure, and deliver answers that can be trusted in high-stakes situations.

The process starts with clarity: knowing exactly what problems you want to solve. Is the priority reducing time spent on document classification? Strengthening audit readiness with transparent logs? Or making research faster with source-backed citations?

Each firm will have different needs, but the best solutions are the ones that consistently balance efficiency, compliance, and reliability.

The Evolution of Tax Software

Tax software has transformed dramatically over the past two decades. What began as digital calculators for forms and filings has evolved into intelligent systems that reshape how professionals manage compliance and research.

Early platforms relied on static, rule-based logic — capable of handling repetitive tasks but unable to adapt to nuanced or evolving tax codes.

Modern solutions now leverage machine learning and anomaly detection models, trained on vast sets of historical filings, to flag irregularities and surface insights with far greater precision.

A defining shift is adaptability. Instead of waiting for manual programming updates, today’s systems learn patterns dynamically, adjusting to changes in tax codes and filing behaviors. This makes them better equipped to handle complex, real-world scenarios.

For instance, enterprise-grade tax platforms now use anomaly detection models to cross-reference filings with live regulatory data, helping professionals prepare audits more efficiently and with fewer errors.

As Dr. Rajesh Mehta, Professor of Computational Taxation at MIT, explains:

“AI’s capacity to contextualize tax data within regulatory frameworks is a game-changer for audit accuracy.”

Despite these advances, one element hasn’t changed: human oversight remains essential. AI can flag anomalies, but professionals are the ones who validate and interpret them. The best systems don’t replace expertise — they amplify it.

What Makes AI Tax Software “the Best”?

When professionals talk about the “best AI tax software”, it isn’t about fancy interfaces or one-off features. It’s about whether the system consistently delivers accuracy, transparency, and compliance under real-world conditions.

The strongest platforms tend to share a few core characteristics:

- Source-linked citations: Every recommendation ties back to official statutes, rulings, or regulatory texts, giving professionals confidence that advice is grounded in verifiable sources.

- Audit-ready version control: Detailed logs track every change and update, creating a transparent history that stands up in reviews or audits.

- Role-based access controls: Sensitive data is only accessible to authorized staff, aligning operations with strict privacy standards like GDPR and SOC 2.

- Seamless integration: The best systems connect smoothly with e-filing portals, practice management software, and accounting tools, eliminating duplicate effort.

- Scalability: From peak filing season to cross-border audits, performance and reliability stay consistent no matter the workload.

Put simply: the “best AI tax software” isn’t the one with the longest feature list, but the one that helps professionals deliver faster, more accurate, and compliant results every single time.

Core Features of AI Tax Solutions

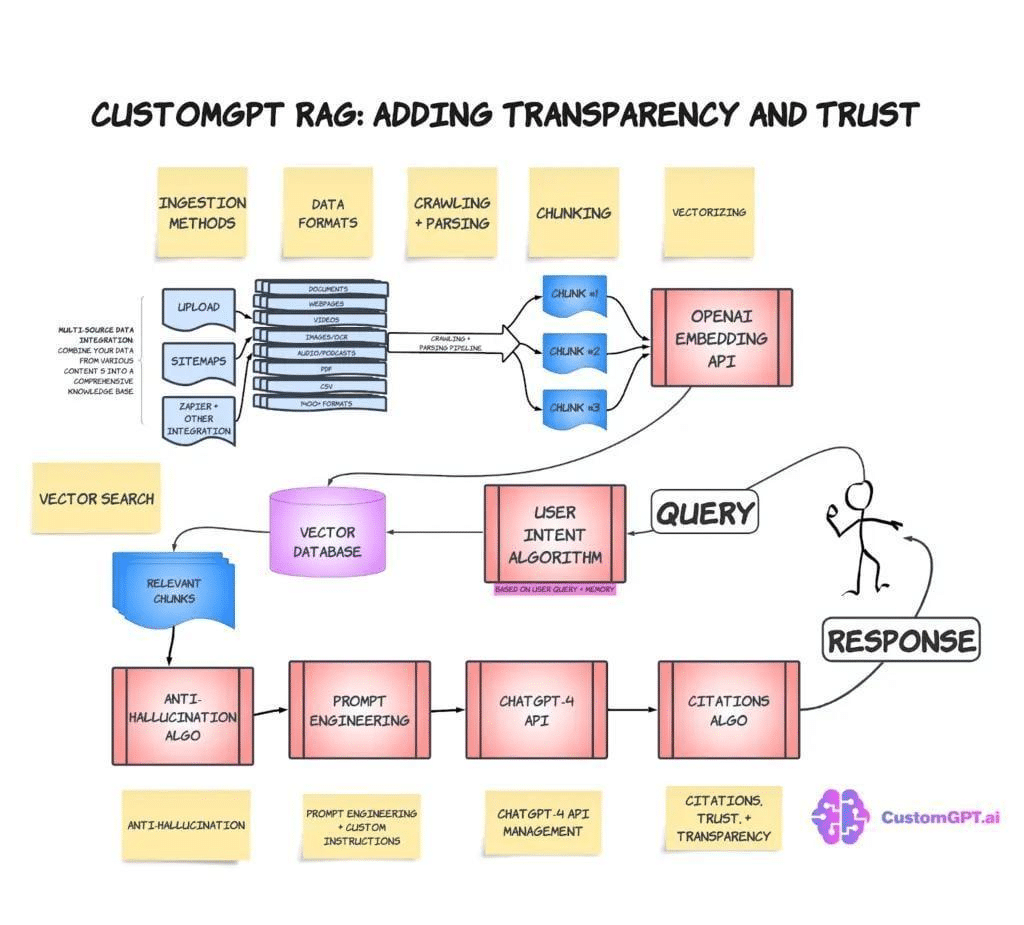

For tax professionals, the promise of AI is not just faster processing — it’s about reliability, compliance, and confidence in every answer.

The best AI tax software stands out because of a handful of core capabilities that make research both scalable and defensible.

OCR with Contextual Extraction

Modern AI doesn’t just scan documents. Optical character recognition (OCR) now comes with contextual understanding, pulling out key details such as income brackets, deduction categories, or references to case law.

This means hours of manual entry can be eliminated, while ensuring accuracy in downstream workflows.

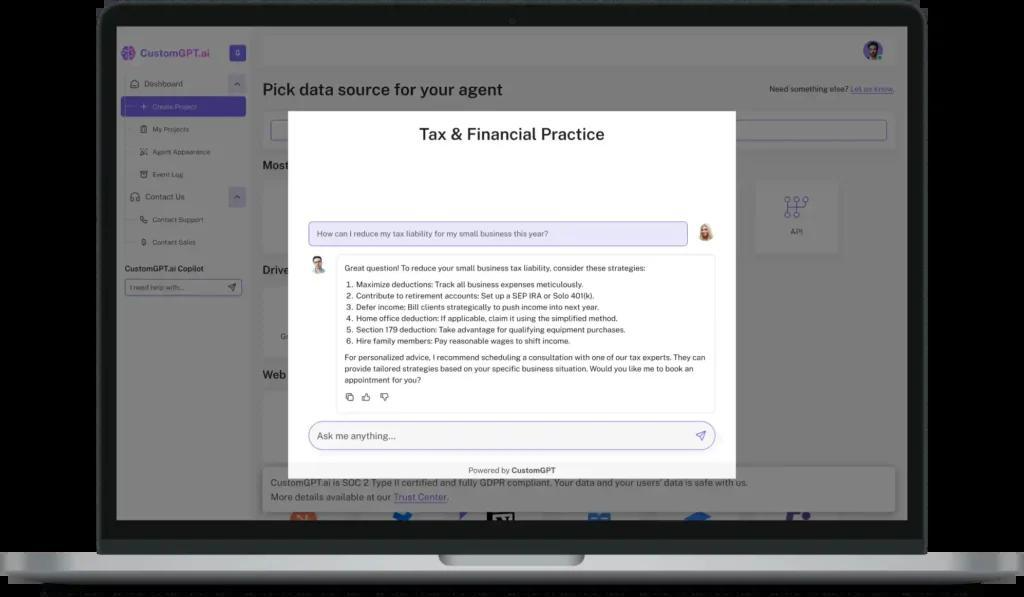

Source-Linked Citations

Every answer needs to be verifiable. Leading AI tax software links responses directly to the underlying regulatory text, official guidance, or legal precedent, ensuring professionals can trace advice back to authoritative sources.

Source-backed citations are especially critical in high-stakes scenarios like audits or tribunal cases, where documented citations strengthen credibility and reduce risk.

Role-Based Access Controls

Sensitive data — client returns, personal identifiers, corporate filings — cannot be accessible to everyone in a firm.

Role-based access controls (RBAC) ensure that only the right people see the right data, aligning systems with compliance standards like GDPR and SOC 2.

Version Control and Audit Logs

Transparency is not optional. With version control, every change to a document or filing is tracked, creating a complete history of edits and updates.

Audit logs provide a defensible trail of who made decisions and when, reinforcing accountability in regulated environments.

Seamless Integration

AI is most valuable when it fits into the tools professionals already use. Modern platforms are designed to integrate with practice management systems, e-filing portals, and document repositories.

This reduces friction, avoids duplication, and keeps workflows running smoothly.

Scalability and Reliability

Whether it’s handling hundreds of queries a day or tens of thousands during peak season, infrastructure matters. Tax AI platforms must deliver consistent performance, uptime, and responsiveness so professionals can trust them under pressure.

Types of AI Tax Software: Which Is Best for You?

Not all AI tax software is built for the same audience. The right choice depends on whether you’re filing your own returns, managing business accounts, or running a professional practice. Broadly, these tools fall into three categories:

1. Individual Tax Solutions

These AI tools focus on simplifying personal tax preparation. Features often include automated data entry using OCR and deduction recommendations. They are designed for ease of use but typically lack the depth needed for complex or cross-border filings.

2. Business Tax Tools

Small and mid-sized enterprises often choose platforms that integrate with practice management and accounting systems.

By automating classification of expenses and syncing with e-filing portals, these AI solutions reduce manual work and help teams stay compliant without expanding headcount.

3. Professional Tax Platforms

Built for accountants and tax specialists, these tools go beyond automation. They offer source-linked citations, version control, and human-in-the-loop review for handling intricate, high-stakes filings.

Professional platforms are the best fit for firms managing audits, cross-border compliance, and client trust at scale.

The takeaway: the best AI tax software depends on your context. Individuals benefit from simplicity, businesses need efficiency and integration, while professionals demand compliance-grade precision.

Evaluating AI Tax Software Providers

Choosing the best AI tax software isn’t just about features—it’s about whether the system delivers consistent, reliable results in real-world conditions.

The difference between a flashy demo and a tool that holds up under pressure often comes down to three factors:

Integration and Compatibility

Tax software only creates value if it fits into your existing workflow. Look for platforms that integrate seamlessly with practice management tools, accounting software, and e-filing systems.

API-first architectures are often the most flexible, ensuring smooth data exchange without duplication.

Compliance and Security

Client tax data is among the most sensitive information firms handle. Providers should demonstrate compliance with standards like SOC 2 and ISO 27001, alongside robust encryption and role-based access controls.

Transparent audit logs and version histories are not optional—they’re the foundation of trust.

Accuracy and Human Oversight

Even the most advanced AI needs human-in-the-loop validation to handle ambiguous or high-stakes scenarios. Strong providers not only build this into their platforms but also make it easy for professionals to refine results and reduce false positives over time.

In short, the best AI tax software providers are those that combine technical strength with accountability—delivering systems that adapt to evolving tax codes while ensuring every answer can be defended under audit.

Key Features to Consider

Not every platform that calls itself “AI-powered” delivers the same level of reliability. When evaluating options, tax professionals should focus on a handful of non-negotiable features that separate useful tools from risky ones.

Source-Linked Citations

In tax, every recommendation must be backed by a verifiable source. Platforms that provide sentence-level citations give professionals confidence that their guidance can withstand audit scrutiny.

Without this feature, even advanced tools risk undermining compliance.

Version Control and Audit Logs

Compliance is not just about accuracy in the moment — it’s about accountability over time. Version control ensures that every change to a filing is tracked, while audit logs provide a defensible history of who made updates and when.

This creates transparency that regulators expect and clients value.

Role-Based Access Controls

Sensitive financial data should never be universally accessible. Role-based access controls (RBAC) restrict visibility based on role and responsibility, aligning with data privacy requirements such as GDPR and SOC 2.

This prevents accidental exposure and builds client trust.

Together, these features make the difference between software that simply automates tasks and platforms that truly enhance compliance, security, and efficiency.

Avoiding Common Pitfalls in Choosing AI Tools

Not every AI solution marketed to tax professionals lives up to its promises. Many firms rush into adoption, only to discover hidden drawbacks that slow workflows instead of streamlining them.

Some of the most common pitfalls include:

- Overvaluing flashy features: Tools that promise anomaly detection or predictive insights may look impressive, but without reliable training data and human-in-the-loop validation, results can be inconsistent.

- Ignoring integration challenges: A system that doesn’t connect easily with practice management or e-filing platforms can create bottlenecks rather than efficiencies.

- Underestimating scalability needs: Software that performs well during normal workloads may struggle under the pressure of peak filing seasons, creating risks when speed and accuracy matter most.

- Overlooking compliance and security: Without safeguards like audit logs and role-based access, firms risk exposing sensitive data or falling short of industry standards.

Avoiding these traps means looking past marketing promises and focusing on whether a platform is designed for the day-to-day realities of tax work — where accuracy, accountability, and resilience are non-negotiable.

Case Studies and Real-World Lessons

The true measure of AI tax software lies not in vendor promises but in how it performs in the field. Case studies highlight both the benefits and the challenges of adoption, offering valuable lessons for firms considering a shift.

TaxWorld: Scaling Without Engineers

TaxWorld, a lean startup serving small accounting firms, faced the challenge of delivering expert-level research on a shoestring budget. Without an engineering team, they turned to CustomGPT.ai to build their AI assistant, Ezylia. The results were striking:

- 97.5% of queries handled successfully

- 200% year-over-year revenue growth

- 500+ hours saved per week across client firms

Founder & CEO Alan Moore summed it up:

“CustomGPT.ai let us punch far above our weight. With almost no engineering budget, we built an assistant that now answers tens of thousands of complex tax questions and fuels our revenue growth every month.”

The lesson: simplicity and no-code deployment can give smaller firms the same leverage as enterprise players, provided the system is secure, citation-backed, and scalable.

👉 Read the TaxWorld the full case study.

Expert Opinions and Industry Standards

AI in tax workflows is evolving quickly, but experts agree on one point: the technology must meet the same standards of transparency and accountability that define the profession itself.

- The Call for Transparency

Leaders consistently emphasize that source-linked citations are non-negotiable. Without clear references back to statutes, rulings, or official guidance, AI-generated outputs risk reducing trust.

Transparent citation features help professionals feel more confident in guidance delivered by AI tools.

- The Role of Human Oversight

Experts caution against relying solely on automation.

Many stress that “human-in-the-loop” (HITL) validation remains essential to interpret ambiguous cases, validate flagged anomalies, and ensure that automation enhances — rather than overrides — expert judgment in high-stakes tax work.

- Aligning with Global Standards

Beyond functionality, AI tax software must align with regulatory and security frameworks such as SOC 2, GDPR, and ISO 27001. Features like version control and audit-logs provide records of decisions and edits.

These help meet compliance obligations, especially when firms are regulated or subject to external audits.

FAQs

What are the must-have features in the best AI tax software?

The best AI tax software should include source-linked citations, version control with audit logs, role-based access controls (RBAC), and OCR with contextual extraction. These features ensure answers are accurate, traceable, and compliant with frameworks like SOC 2 and GDPR.

How accurate are AI-powered tax tools?

Accuracy depends on three factors: the quality of the data sources, how often those sources are updated, and whether human oversight is built into the workflow. Top platforms combine domain-specific training with human-in-the-loop review to minimize errors and ensure compliance.

Can small firms afford AI tax solutions?

Yes. Many modern platforms are designed with scalability and no-code configurability, meaning firms don’t need large IT teams to deploy them. For small practices, the investment often pays off in time saved, fewer research errors, and faster client delivery.

Will AI replace tax professionals?

No. In most cases, AI handles the repetitive research and document work. Professionals still make the interpretations, judgments, and final decisions, especially in complex or unusual cases. AI serves to augment, not replace.

Is AI safe for client data and privacy?

When properly implemented, yes. Key safeguards include encryption, RBAC, audit trails, and compliance certifications (e.g., SOC 2, GDPR). These measures ensure sensitive tax data remains secure and only accessible to authorized personnel.

How do I choose between different AI tax software providers?

Evaluate providers based on feature depth, security compliance, integration with your existing systems, and user track record. Look for case studies, such as TaxWorld’s use of CustomGPT.ai, which show how the software performs under real-world conditions.

Conclusion: From Overload to Efficiency

Tax compliance isn’t getting easier, but the tools available to professionals are getting smarter. The best AI tax software doesn’t just speed up processes — it creates transparency, ensures compliance, and gives firms the confidence to handle complex tax matters at scale.

By combining features like source-linked citations, role-based access, and audit-ready logs, these platforms move beyond efficiency to become true partners in accountability.

For firms of all sizes, the choice is no longer whether to adopt AI, but which solution will best align with their workflows and compliance needs. The difference lies in choosing a provider that delivers both innovation and trust.

👉 Want to see what this looks like in practice? Read the TaxWorld case study and discover how one lean firm used AI to turn research bottlenecks into a growth engine.

Scale your practice with the best AI tax software

Streamline compliance, boost accuracy, and scale expertise using AI tax software.

Trusted by thousands of organizations worldwide