TLDR

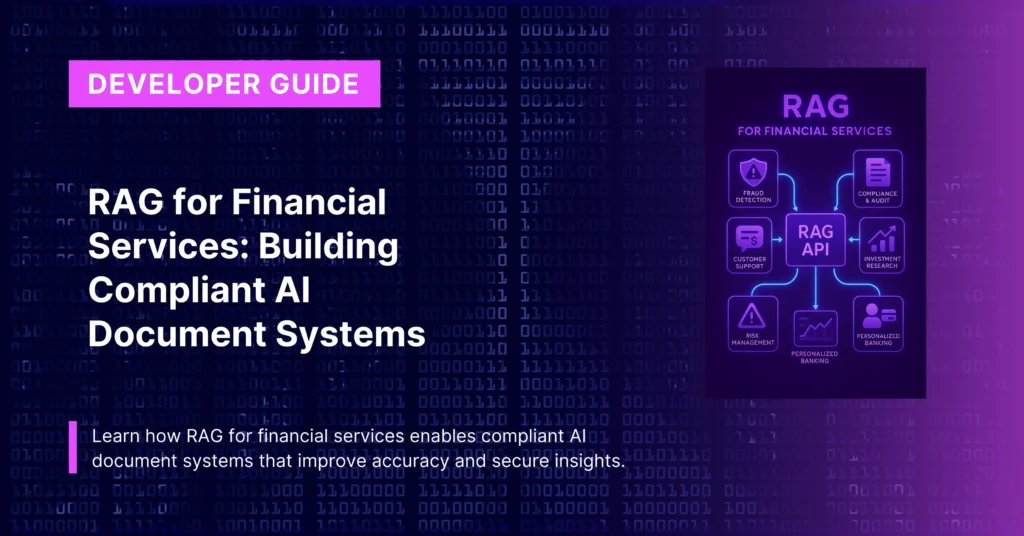

RAG for financial services enable regulatory compliance, risk assessment, and client service while meeting strict security requirements.

CustomGPT.ai’s SOC-2 certified platform processes financial documents, regulatory texts, and client data with enterprise-grade security. Implementation reduces regulatory research time by 70% and accelerates compliance workflows with full audit trails.

Financial services organizations handle the world’s most sensitive data under intense regulatory oversight. Yet most still rely on manual document searches, inconsistent policy interpretations, and time-consuming compliance processes that slow business operations.

RAG technology offers financial institutions a path to modernize these processes while exceeding regulatory requirements. The key is understanding how to implement RAG systems that work within financial services’ unique constraints.

Why Financial RAG Requires Special Considerations

Financial services can’t simply adopt any AI solution. Every system must meet stringent requirements:

- Regulatory Compliance: Systems must comply with SOX, Basel III, MiFID II, FINRA, and data protection laws like GDPR while maintaining complete audit trails.

- Data Security: Client information, trading data, and risk assessments require enterprise-grade security with encryption, access controls, and SOC-2 Type II compliance.

- Auditability: Regulators must understand AI decision-making processes. RAG systems must provide clear source citations and decision trails.

- Real-time Performance: Trading systems and fraud detection need sub-second responses without compromising accuracy or compliance.

Financial Services RAG Applications

1. Regulatory Compliance Research

The Compliance Challenge

Compliance teams at major financial institutions spend 60-70% of their time researching regulatory requirements across thousands of evolving documents. Different departments often interpret the same regulation differently, creating compliance risks.

CustomGPT.ai’s RAG API transforms regulatory research by instantly searching across all regulatory documents, internal policies, and precedent decisions. When compliance officers ask “What are the latest Basel III operational risk capital requirements?” the system provides specific answers with exact source citations.

Implementation Example:

Using CustomGPT’s OpenAI-compatible API:

from openai import OpenAI

client = OpenAI(

api_key="CUSTOMGPT_API_KEY",

base_url="https://app.customgpt.ai/api/v1/projects/{compliance_project_id}/"

)

response = client.chat.completions.create(

model="gpt-4",

messages=[{

"role": "user",

"content": "What are current FINRA requirements for client suitability assessments in equity trading?"

}]

)Compliance Benefits:

- 70% reduction in regulatory research time

- Consistent interpretation across all departments

- Automatic tracking of regulatory changes

- Complete audit trail for regulatory examinations

2. Client Document Analysis and KYC

The KYC Challenge

Investment advisors manually analyze thousands of client documents for Know Your Customer (KYC) compliance, suitability assessments, and risk profiling. This process is slow, error-prone, and inconsistent across advisors.

RAG-Powered Client Analysis

CustomGPT.ai processes financial statements, tax returns, investment portfolios, and identity documents with automatic extraction of relevant compliance information. The platform supports over 1000 file formats including complex financial documents.

Financial institutions report processing client documents 5x faster while maintaining higher accuracy than manual review.

Key Capabilities:

- Automated KYC Processing: Identity verification and risk scoring from uploaded documents

- Suitability Analysis: Investment recommendation compliance based on client profiles

- AML Screening: Transaction pattern analysis and suspicious activity detection

- Beneficial Ownership: Corporate structure analysis for complex entities

3. Risk Assessment and Portfolio Analysis

Risk Management Challenge

Risk teams need real-time insights across multiple data sources for comprehensive risk assessment. Traditional approaches involve manual analysis of market data, financial statements, and industry reports.

Intelligent Risk Analysis

RAG systems provide automated risk assessment by analyzing current financial statements, market conditions, industry reports, and historical performance data simultaneously.

Using CustomGPT’s native SDK:

from customgpt_client import CustomGPT

import uuid

CustomGPT.api_key = "API_KEY"

session_id = uuid.uuid4()

risk_response = CustomGPT.Conversation.send(

project_id="<RISK_ASSESSMENT_PROJECT>",

session_id=session_id,

prompt="Analyze credit risk for Acme Corp based on Q3 financials and current market conditions"

)Risk Management Benefits:

- Real-time risk scoring with supporting evidence

- Consistent risk methodology across all assessments

- Integration with existing risk management systems

- Comprehensive audit trails for regulatory reporting

4. Trading Compliance and Pre-Trade Checks

Trading Compliance Challenge

Trading desks need instant access to position limits, client restrictions, regulatory requirements, and internal policies before executing trades. Manual checks slow trading and create compliance risks.

Automated Trading Compliance

RAG systems provide real-time trading compliance checks by analyzing client profiles, position limits, regulatory restrictions, and internal policies. Integration with trading systems enables automated pre-trade compliance validation.

The CustomGPT starter kit includes APIs for real-time compliance checking that can be embedded directly into trading platforms.

5. Customer Service and Account Management

Client Service Challenge

Client service representatives need instant access to account information, product details, regulatory disclosures, and transaction history while maintaining compliance with all applicable regulations.

Enhanced Client Service

RAG-powered customer service provides instant access to client account details, investment performance, product information, and regulatory disclosures—all with appropriate compliance controls and audit logging.

Implementation for Financial Services

Security-First Architecture

Financial RAG implementation starts with security requirements:

- Data Encryption: CustomGPT.ai provides end-to-end encryption with data encrypted at rest and in transit

- Access Controls: Role-based permissions ensuring only authorized personnel access specific information

- Audit Logging: Complete logging of all queries, responses, and user interactions for regulatory compliance

- Compliance Certifications: SOC-2 Type II certified with GDPR compliance

Regulatory Documentation Processing

CustomGPT.ai automatically processes complex financial documents:

- Regulatory Texts: SEC filings, FINRA rules, Basel III requirements

- Internal Policies: Trading procedures, compliance manuals, risk policies

- Client Documents: Financial statements, tax returns, investment agreements

- Market Data: Research reports, earnings calls, industry analysis

The platform handles automatic OCR, document parsing, and content extraction without manual preprocessing.

Integration with Core Banking Systems

Financial institutions can integrate RAG capabilities with existing systems using multiple approaches:

- API Integration: Direct integration using CustomGPT’s REST API

- OpenAI Compatibility: Drop-in replacement for existing OpenAI implementations

- MCP Support: Integration with agent frameworks using Model Context Protocol

Deployment Options

- Cloud Deployment: Fully managed service with enterprise SLAs

- Private Cloud: Dedicated instances for enhanced security

- Hybrid Architecture: On-premises sensitive data with cloud processing for non-sensitive content

Performance and Compliance Monitoring

Audit Trail Requirements

Every RAG interaction generates comprehensive audit logs:

- User identification and role verification

- Query content and classification

- Response sources and confidence levels

- Compliance validation results

- Access control verification

Real-Time Compliance Checking

Financial RAG systems include built-in compliance validation:

- Automatic redaction of sensitive information

- Role-based response filtering

- Regulatory requirement verification

- Policy compliance confirmation

Performance Metrics

Operational Efficiency:

- Regulatory research time: 70% average reduction

- Document processing speed: 10x faster than manual review

- Client onboarding time: 50% improvement

- Compliance query resolution: Under 5 seconds average

Quality Metrics:

- Response accuracy: >95% for regulatory queries

- Compliance validation: 100% success rate

- Audit finding reduction: 60% fewer compliance issues

- Client satisfaction: 40% improvement in service ratings

Implementation Roadmap

Phase 1: Pilot Implementation (Weeks 1-4)

- Account Setup: Create your CustomGPT.ai account and configure security settings

- Document Ingestion: Upload regulatory documents, policies, and procedures

- User Configuration: Set up role-based access controls for compliance team

- Testing: Validate responses against known regulatory requirements

Phase 2: Department Rollout (Weeks 5-8)

- Expanded Content: Add client documents, market research, and internal procedures

- Integration: Connect with existing compliance and risk systems using APIs

- Training: User workshops on effective prompting and compliance procedures

- Monitoring: Implement audit logging and performance tracking

Phase 3: Enterprise Deployment (Weeks 9-12)

- Multi-Agent Architecture: Separate agents for different business lines

- Advanced Analytics: Usage patterns and compliance reporting

- Voice Integration: Hands-free operation for trading floors and field personnel

- Continuous Improvement: Regular model updates and optimization

Regulatory Compliance Features

Built-in Compliance Controls

CustomGPT.ai includes features specifically designed for financial services:

- Source Attribution: Every response includes exact document citations

- Confidence Scoring: Reliability indicators for all AI-generated content

- Version Control: Track changes to regulatory documents and policies

- Access Auditing: Complete logs of who accessed what information when

Multi-Jurisdiction Support

Global financial institutions need compliance across multiple regulatory environments:

- Regional Agents: Separate RAG agents for different jurisdictions

- Regulatory Mapping: Automatic identification of applicable regulations

- Cross-Border Compliance: Coordination across multiple regulatory frameworks

Getting Started with Financial RAG

Immediate Implementation

- Create Pilot Agent: Sign up at app.customgpt.ai and create a compliance-focused agent

- Upload Key Documents: Start with most frequently referenced regulatory documents

- Configure Security: Set up role-based access and audit logging

- Deploy Interface: Use the starter kit for custom deployment

Technical Integration

For custom implementations, leverage CustomGPT’s comprehensive API:

# Example compliance query with audit logging

from customgpt_client import CustomGPT

import datetime

def compliant_query(user_id, query, project_id):

# Log query initiation

audit_log = {

'timestamp': datetime.utcnow(),

'user_id': user_id,

'query_hash': hash(query),

'project_id': project_id

}

response = CustomGPT.Conversation.send(

project_id=project_id,

session_id=f"audit_{user_id}_{datetime.utcnow().timestamp()}",

prompt=query

)

# Log response with sources

audit_log.update({

'response_id': response.id,

'sources_count': len(response.sources),

'confidence_score': response.confidence

})

return response, audit_logAdvanced Features

- Voice Integration: Deploy voice-enabled interfaces for trading floors

- Mobile Access: Secure mobile apps for field personnel and client meetings

- Real-Time Alerts: Automated notifications for regulatory changes

- Performance Analytics: Comprehensive usage and efficiency reporting

Cost-Benefit Analysis

Implementation Investment

Initial Costs:

- CustomGPT.ai subscription: Starting at $99/month for basic features

- Implementation services: $50,000-200,000 depending on scope

- Integration development: 4-12 weeks of development time

Ongoing Costs:

- Platform fees: Based on usage and features

- Maintenance: 10-15% of initial development cost annually

- Compliance monitoring: Included in platform features

Return on Investment

Quantifiable Benefits:

- Compliance research time savings: $200,000-500,000 annually

- Reduced regulatory risk: Potential millions in avoided fines

- Faster client onboarding: $50,000-150,000 annually in efficiency gains

- Improved accuracy: Reduced errors and associated costs

Most financial institutions see positive ROI within 6-12 months of implementation.

FAQ

Is RAG technology approved for financial services use?

RAG technology itself isn’t regulated, but its implementation must meet financial services requirements. CustomGPT.ai’s SOC-2 Type II certification and enterprise security features are designed for financial services compliance.

How do we handle data privacy requirements like GDPR?

CustomGPT.ai provides GDPR-compliant data processing with features for data minimization, consent management, and right to erasure. All personal data processing includes appropriate safeguards and audit trails.

Can RAG integrate with our existing trading and risk systems?

Yes, CustomGPT.ai offers OpenAI-compatible APIs, REST APIs, and comprehensive integration options for connecting with existing financial systems.

What happens if the AI provides incorrect compliance information?

All responses include source citations for verification. CustomGPT.ai is benchmarked #1 for accuracy, but financial institutions should implement review processes for critical compliance decisions and maintain human oversight.

How do we ensure regulatory audit readiness?

The platform provides comprehensive audit trails, source attribution, and compliance reporting features. All interactions are logged with timestamps, user identification, and response sources for regulatory examination.

What’s the typical implementation timeline?

Basic implementations take 4-8 weeks, while full enterprise deployments require 3-6 months including security reviews, compliance validation, and system integration.

Ready to modernize your financial services compliance and risk management? Start with a pilot at app.customgpt.ai or explore enterprise solutions at customgpt.ai.

For more RAG API related information:

- CustomGPT.ai’s open-source UI starter kit (custom chat screens, embeddable chat window and floating chatbot on website) with 9 social AI integration bots and its related setup tutorials.

- Find our API sample usage code snippets here.

- Our RAG API’s Postman hosted collection – test the APIs on postman with just 1 click.

- Our Developer API documentation.

- API explainer videos on YouTube and a dev focused playlist.

- Join our bi-weekly developer office hours and our past recordings of the Dev Office Hours.

P.s – Our API endpoints are OpenAI compatible, just replace the API key and endpoint and any OpenAI compatible project works with your RAG data. Find more here.

Wanna try to do something with our Hosted MCPs? Check out the docs for the same.

Priyansh is Developer Relations Advocate who loves technology, writer about them, creates deeply researched content about them.