AI is rapidly reshaping how financial brands connect with customers, and AI for financial services marketing is becoming a must-have capability for modern agencies.

Make Money With AI

Join our Partner Programs!

Boost your reputation, drive revenue and grow your business with CustomGPT.ai.

From predictive targeting to real-time personalization, AI enables smarter campaigns that resonate with highly regulated, trust-driven audiences.

For marketing agencies, this shift represents both an opportunity and a challenge as clients demand measurable growth without compromising compliance.

Understanding how to apply AI strategically allows agencies to deliver more relevant messaging, optimize spend, and stand out in an increasingly competitive financial services landscape.

Understanding AI’s Role in Financial Services Marketing

AI is transforming financial services marketing by helping agencies balance performance with strict regulatory expectations.

For marketing agencies, using AI effectively means not only driving engagement but also ensuring every campaign aligns with compliance, data privacy, and transparency standards.

As financial services AI marketing continues to mature, agencies that understand AI’s core capabilities can design smarter strategies that scale without increasing risk. This foundation is essential before applying AI to targeting, personalization, or campaign optimization.

How AI Supports Data-Driven Decision Making

AI enables agencies to analyze vast volumes of financial consumer data and uncover insights that would be impossible to identify manually. These insights help marketers predict behaviors, refine messaging, and improve campaign outcomes while maintaining control over sensitive data.

Key ways AI improves decision-making include:

- Identifying high-intent audience segments based on behavioral patterns

- Forecasting campaign performance using predictive analytics

- Optimizing budget allocation across channels in real time

When applied correctly, AI turns raw financial data into actionable marketing intelligence.

Balancing Personalization With Compliance

Personalization is critical in financial marketing, but it must be executed within strict regulatory boundaries. AI allows agencies to tailor messaging dynamically while adhering to approved language, disclosures, and risk guidelines.

AI helps agencies stay compliant by:

- Enforcing pre-approved content frameworks automatically

- Monitoring personalization rules to avoid misleading claims

- Adjusting messaging based on jurisdiction-specific regulations

This balance ensures campaigns feel relevant without exposing clients to compliance risks.

Automating Campaign Optimization Safely

AI-driven optimization helps agencies refine campaigns continuously without constant manual intervention. In regulated industries, automation must be carefully controlled to prevent unauthorized changes or non-compliant variations.

Safe optimization strategies using AI include:

- Automated A/B testing within approved content parameters

- Performance-based adjustments that exclude sensitive variables

- Real-time alerts when campaigns approach compliance thresholds

With the right safeguards, AI automation enhances efficiency while protecting brand integrity.

Building Trust Through Transparent AI Usage

Trust is central to financial services marketing, and agencies must be transparent about how AI influences customer experiences. Clear AI governance reassures both clients and regulators that technology is being used responsibly.

Best practices for transparent AI usage include:

- Documenting how AI models make targeting and content decisions

- Maintaining audit trails for AI-driven campaign changes

- Regularly reviewing AI outputs for bias or risk exposure

By prioritizing transparency, agencies strengthen long-term client relationships and campaign credibility. This foundational understanding sets the stage for applying AI more strategically across targeting, content, and compliance workflows in financial services marketing.

Using AI to Enhance Audience Targeting and Segmentation

Effective audience targeting is especially critical in financial services, where relevance, trust, and timing directly impact conversions. AI allows agencies to move beyond basic demographics and build smarter segmentation models that respect privacy while improving performance.

By applying AI-driven marketing for finance, agencies can uncover nuanced audience insights and activate them across compliant campaigns. This approach helps financial brands reach the right users with the right message—without overstepping regulatory boundaries.

Leveraging Predictive Analytics for Smarter Targeting

Predictive analytics uses AI to anticipate customer behavior based on historical and real-time data. This enables AI agencies to identify prospects who are most likely to convert or engage with specific financial products.

How predictive analytics improves targeting:

- Scores leads based on likelihood to take action

- Anticipates customer needs before intent is explicit

- Reduces wasted spend on low-propensity audiences

When used responsibly, predictive targeting increases efficiency while maintaining ethical data use. Targeting becomes more proactive and data-informed rather than reactive.

Creating Privacy-Safe Customer Segments

Financial data is highly sensitive, making privacy-safe segmentation essential. AI helps agencies build meaningful segments without relying on personally identifiable information.

AI supports compliant segmentation by:

- Using anonymized and aggregated data models

- Identifying behavioral patterns instead of individual identities

- Adapting segments as regulations or consent rules change

This ensures segmentation remains both effective and regulation-ready. Privacy-first targeting strengthens consumer trust and long-term brand value.

Improving Lookalike and Prospecting Audiences

AI-powered lookalike modeling allows agencies to expand reach while maintaining relevance. By analyzing existing high-value customers, AI identifies similar profiles without copying sensitive attributes.

Benefits of AI-driven prospecting include:

- Higher-quality acquisition audiences

- Reduced risk of biased or non-compliant targeting

- Faster scaling of successful campaigns

This approach supports growth while aligning with financial marketing standards. Smarter prospecting helps agencies scale confidently in regulated markets.

Adapting Targeting in Real Time

AI enables real-time adjustments to targeting strategies based on performance signals and market conditions. This flexibility is especially valuable in finance, where consumer sentiment can change quickly.

Real-time AI targeting capabilities include:

- Adjusting audience criteria based on engagement trends

- Pausing underperforming segments automatically

- Responding to economic or seasonal shifts

Dynamic targeting keeps campaigns efficient and relevant without manual intervention. This agility gives agencies a competitive edge in fast-moving financial markets.

This targeting foundation enables agencies to apply AI more effectively to content creation and messaging, which is the next critical layer of financial services marketing success.

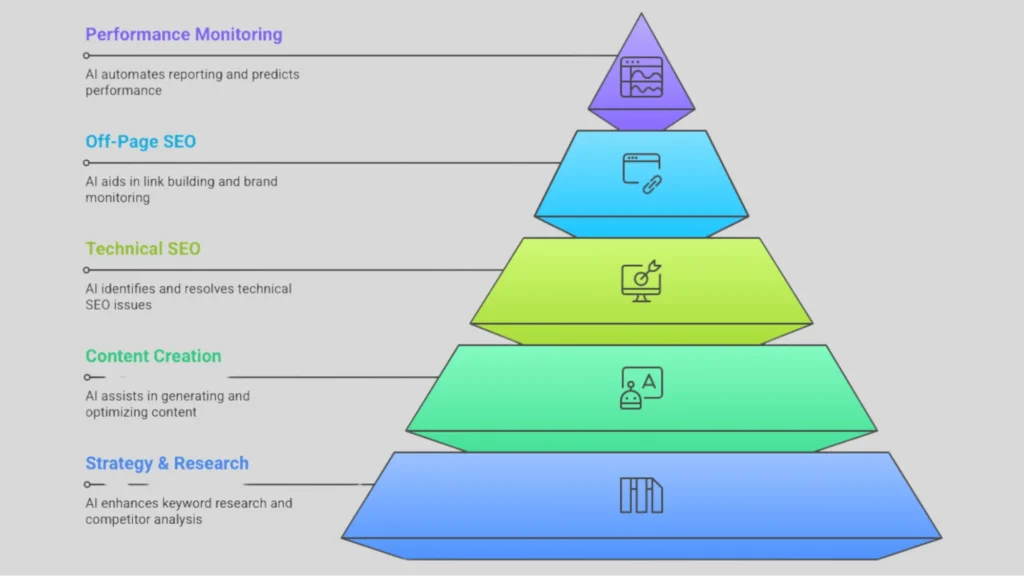

Image source: macronimous.com

Creating Compliant and High-Performing AI-Driven Content

Content in financial services must educate, persuade, and comply—all at the same time. AI helps agencies scale content production while maintaining consistency, accuracy, and regulatory alignment across channels.

With AI for financial services marketing, agencies can produce personalized yet compliant messaging faster, ensuring every asset meets brand, legal, and performance standards. This makes AI a powerful ally for content teams working under tight constraints.

Using AI to Generate Regulation-Ready Content

AI content tools can assist agencies by drafting copy that follows predefined compliance rules and tone guidelines. This reduces revision cycles and minimizes the risk of non-compliant language reaching production.

Ways AI supports compliant content creation:

- Generates copy using pre-approved claims and disclosures

- Maintains consistent tone across ads, emails, and landing pages

- Flags restricted phrases or promises automatically

- Speeds up content ideation without bypassing legal review

This allows agencies to scale content output while staying within guardrails. Reliable AI-assisted drafting frees teams to focus on strategy rather than rewrites.

Personalizing Messaging Without Increasing Risk

Personalization improves engagement, but in finance it must be tightly controlled. AI enables personalization based on behavior and context rather than sensitive personal attributes.

Safe personalization techniques powered by AI include:

- Dynamic messaging based on funnel stage

- Content variations tied to intent signals, not identity

- Rule-based personalization approved by compliance teams

This ensures relevance without exposing brands to regulatory scrutiny. Controlled personalization builds trust while still improving performance.

Maintaining Brand and Legal Consistency at Scale

As campaigns expand across platforms, consistency becomes harder to manage manually. AI helps enforce brand and legal standards across every asset.

AI-driven consistency benefits include:

- Automated brand voice alignment across formats

- Centralized content rules applied at scale

- Reduced human error in repetitive content tasks

Consistency strengthens credibility, especially in high-trust industries like finance. This approach helps agencies deliver polished, compliant campaigns across channels.

Reviewing and Optimizing Content Performance

AI doesn’t stop at creation—it also evaluates how content performs in real-world conditions. Agencies can use AI insights to refine messaging without introducing compliance risk.

Content optimization with AI often includes:

- Identifying high-performing compliant language patterns

- Testing approved variations safely

- Measuring engagement without tracking sensitive data

These insights guide smarter iterations over time. Continuous improvement ensures financial content remains both effective and responsible.

Optimizing Campaign Performance While Meeting Regulatory Standards

Performance optimization in financial services requires a careful balance between agility and control. AI helps agencies improve results continuously while respecting approval workflows, disclosure requirements, and regulatory limitations.

By applying compliant AI marketing strategies, agencies can enhance efficiency without introducing unnecessary risk. This allows teams to focus on growth while maintaining confidence in every optimization decision.

Automating A/B Testing Within Compliance Guardrails

AI-powered testing enables agencies to improve performance without manually managing every variation. In financial marketing, testing must stay within approved content and structural boundaries.

How AI enables safe A/B testing:

- Tests only pre-approved copy and design elements

- Automatically pauses non-compliant or underperforming variants

- Tracks performance without altering required disclosures

This approach accelerates learning while preserving regulatory integrity. Smarter testing leads to faster insights without compliance setbacks.

Using AI to Optimize Media Spend Responsibly

AI can dynamically adjust bids and budgets based on performance signals, helping agencies maximize ROI. In regulated industries, these optimizations must avoid targeting restricted audiences or placements.

Responsible media optimization includes:

- Budget reallocation based on compliant performance metrics

- Channel optimization that excludes high-risk environments

- Continuous monitoring of spend against policy constraints

These controls ensure efficiency without sacrificing oversight. Responsible automation protects both performance and reputation.

Monitoring Campaign Risk in Real Time

AI can detect potential compliance issues before they escalate into serious problems. Real-time monitoring allows agencies to respond quickly to anomalies or policy violations.

Image source: v-comply.com

AI-powered risk monitoring capabilities include:

- Alerts for unusual performance spikes or drops

- Detection of messaging deviations across platforms

- Identification of placement or targeting conflicts

Proactive risk management reduces exposure and builds client trust. Early detection keeps campaigns running smoothly.

Balancing Speed and Governance in Optimization

AI increases speed, but governance ensures accountability. Agencies must define clear rules around what AI can and cannot adjust.

Effective governance frameworks often include:

- Approval hierarchies for AI-driven changes

- Audit logs for optimization decisions

- Regular reviews of automated rulesets

This balance ensures innovation doesn’t outpace compliance. Strong governance enables sustainable AI-driven growth. Together, these optimization practices help agencies deliver high-performing financial campaigns that meet regulatory standards and client expectations.

FAQ

How can AI improve marketing results in financial services without breaking compliance rules?

AI works within predefined guardrails, using approved language, targeting rules, and disclosures to optimize performance while staying compliant.

Is AI safe to use with sensitive financial customer data?

Yes, when implemented correctly, AI relies on anonymized, consent-based, and aggregated data rather than personally identifiable information.

Can AI help marketing agencies scale content for financial clients?

AI accelerates content creation by generating regulation-ready drafts, maintaining brand consistency, and reducing manual review cycles.

What types of financial marketing campaigns benefit most from AI?

AI is especially effective for audience targeting, personalized messaging, media optimization, and performance monitoring in regulated environments.

Do agencies need technical expertise to use AI for financial services marketing?

No, most AI marketing tools are designed for non-technical teams and integrate easily into existing workflows with proper governance in place.

Conclusion

AI is no longer a future consideration for financial services marketing—it’s a practical advantage for agencies that know how to apply it responsibly.

By combining intelligent automation with strong governance, agencies can deliver more relevant, compliant, and high-performing campaigns that meet both client expectations and regulatory demands.

As competition increases and compliance pressures grow, agencies that master AI-driven strategies will be better positioned to scale results without increasing risk.

The key lies in using AI as a controlled enabler—enhancing targeting, content, and optimization while preserving trust and transparency.

Ready to take the next step? Explore how AI-powered co-selling strategies can help your agency unlock new revenue opportunities, strengthen client relationships, and deliver measurable value across regulated industries.

Start building smarter, more scalable financial marketing solutions today.